W9 Form Printable

W9 Form Printable - A foreign person, including a u.s. Access irs forms, instructions and publications in electronic and print media. Skip to main content an official website of the united states government. (for a sole proprietor or disregarded entity, enter the owner’s name. • an individual who is a u.s. Request for student's or borrower's taxpayer identification number and certification : If you are a u.s. If you are a u.s. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. Branch of a foreign person that is treated as a u.s. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. (for a sole proprietor or disregarded entity, enter the owner’s name. Skip to main content an official website of the united states government. • an individual who is a u.s. If you are a u.s. Skip to main content an official website of the united states government. For federal tax purposes, you are considered a u.s. For federal tax purposes, you are considered a u.s. If you are a u.s. (for a sole proprietor or disregarded entity, enter the owner’s name. If you are a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. A foreign person, including a u.s. (for a sole proprietor or disregarded entity, enter the owner’s name. For federal tax purposes, you are considered a u.s. Access irs forms, instructions and publications in electronic and print media. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. For federal tax purposes, you are considered a u.s. Branch of a foreign person that is treated as a u.s. Skip to main content an official website of. Branch of a foreign person that is treated as a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. Request for student's or borrower's taxpayer identification number and certification : If you are a u.s. For federal tax purposes, you are considered a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. A foreign person, including a u.s. If you are a u.s. Skip to main content an official website of the united states government. If you are a u.s. A foreign person, including a u.s. Request for student's or borrower's taxpayer identification number and certification : Skip to main content an official website of the united states government. Branch of a foreign person that is treated as a u.s. If you are a u.s. Branch of a foreign person that is treated as a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. If you are a u.s. If you are a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. A foreign person, including a u.s. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. (for a sole proprietor or disregarded entity, enter the owner’s name. For federal tax purposes,. Branch of a foreign person that is treated as a u.s. Skip to main content an official website of the united states government. A foreign person, including a u.s. • an individual who is a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. Access irs forms, instructions and publications in electronic and print media. A foreign person, including a u.s. If you are a u.s. For federal tax purposes, you are considered a u.s. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3. If you are a u.s. • an individual who is a u.s. Request for student's or borrower's taxpayer identification number and certification : If you are a u.s. Skip to main content an official website of the united states government.Irs W 9 Printable Form 2021 Printable Form 2024

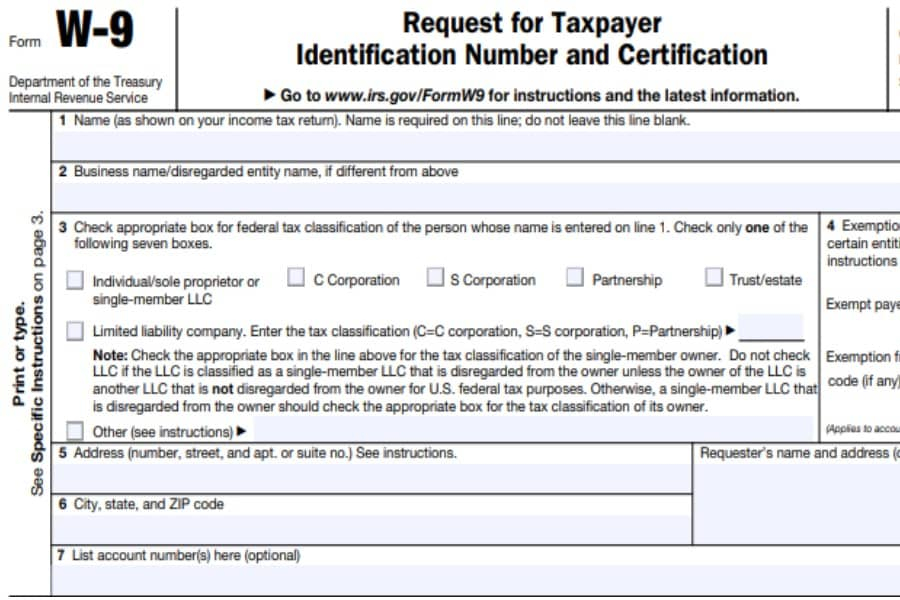

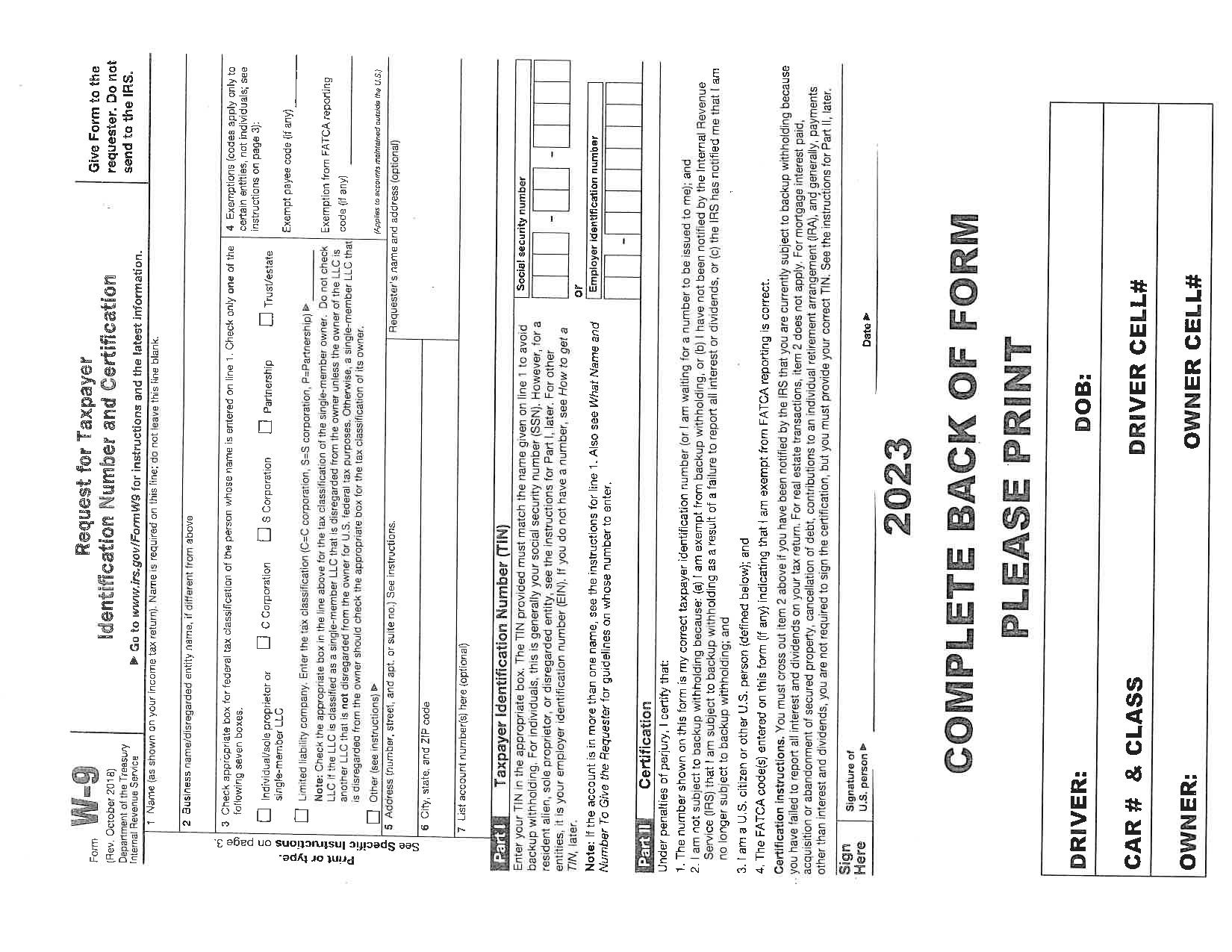

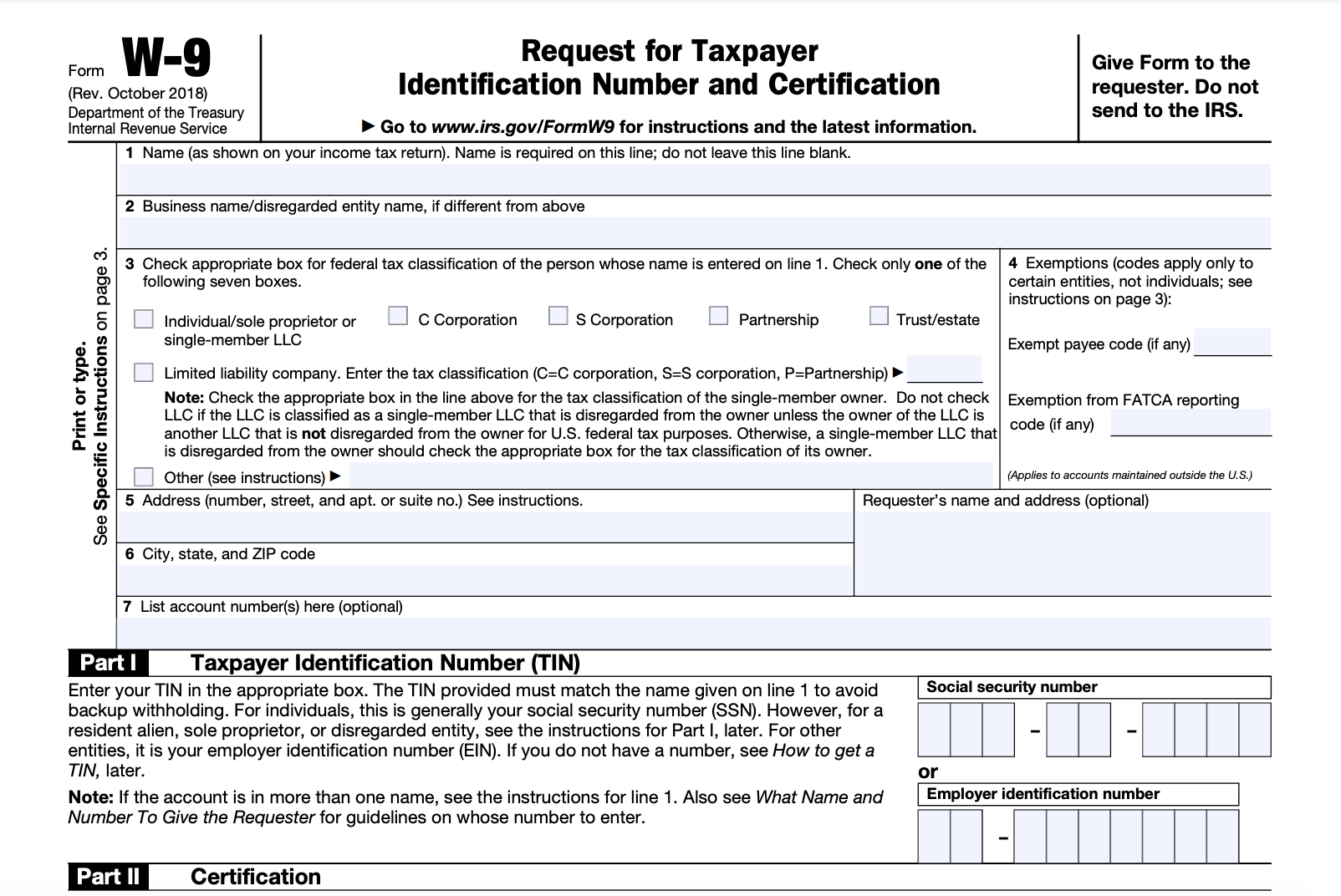

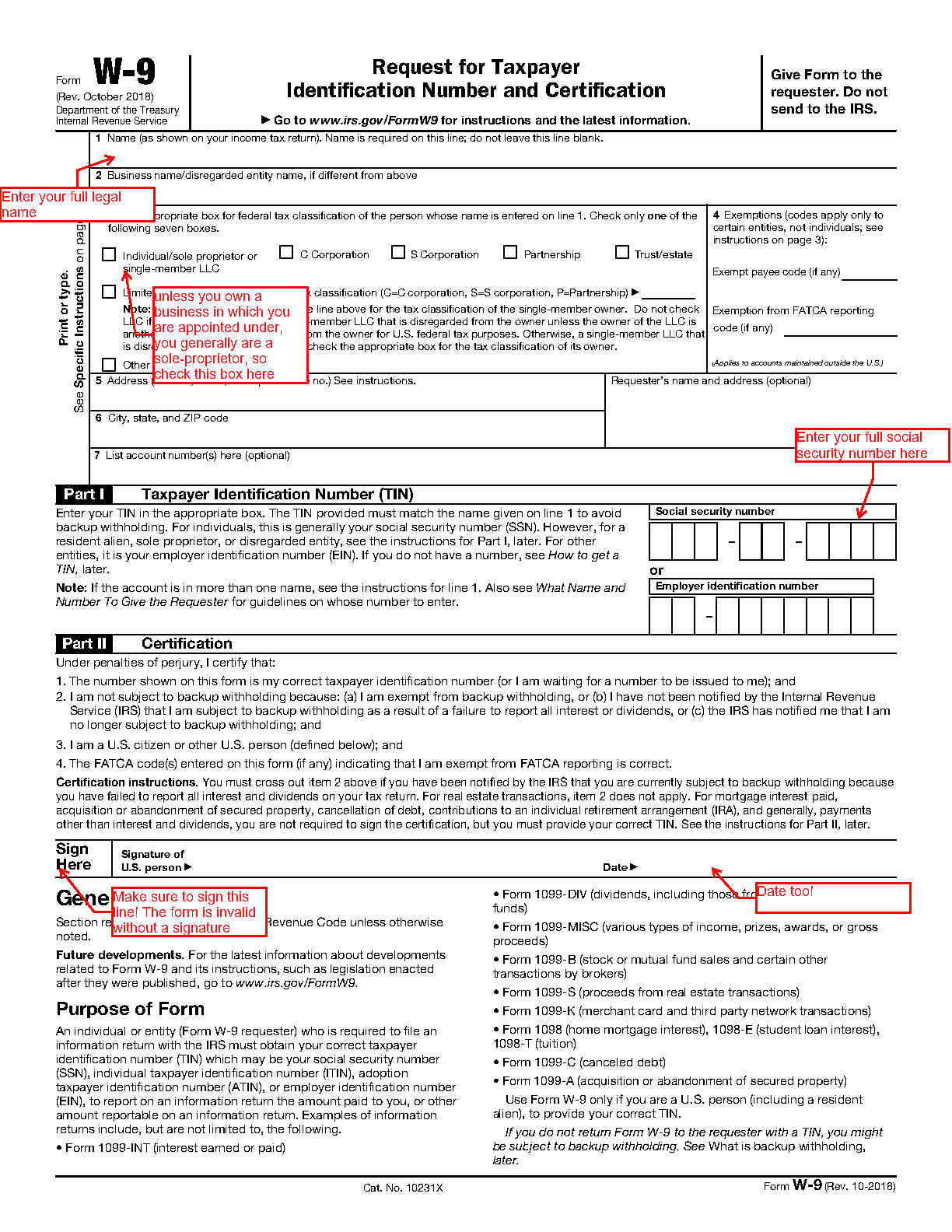

Blank W 9 Form 2024 Fillable Printable IRS W9 Tax Blank in PDF

W 9 Form For 2020 Printable Example Calendar Printable

Blank W 9 Form 2024 Printable Kalli Merola

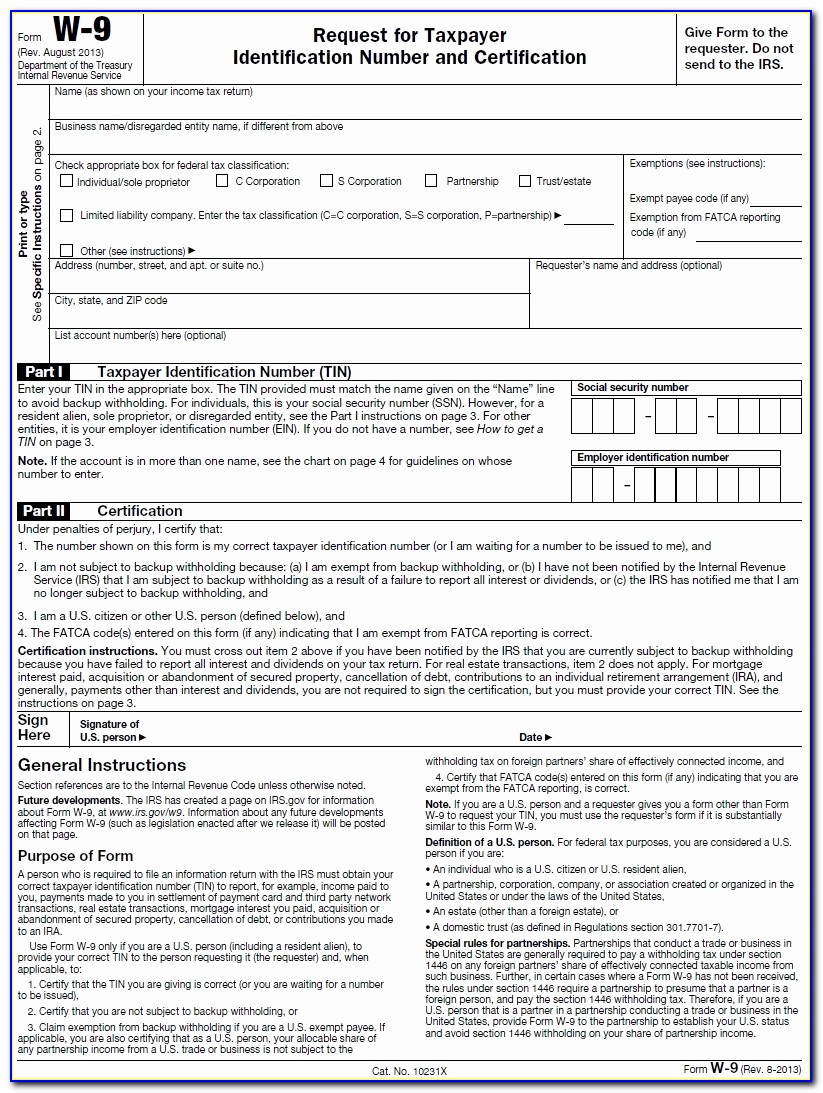

Irs Form W 9 Fillable Printable Forms Free Online

2024 W 9 Form Blank Eden Othella

W9 Form—Fill Out the IRS W9 Form Online for 2023 Smallpdf

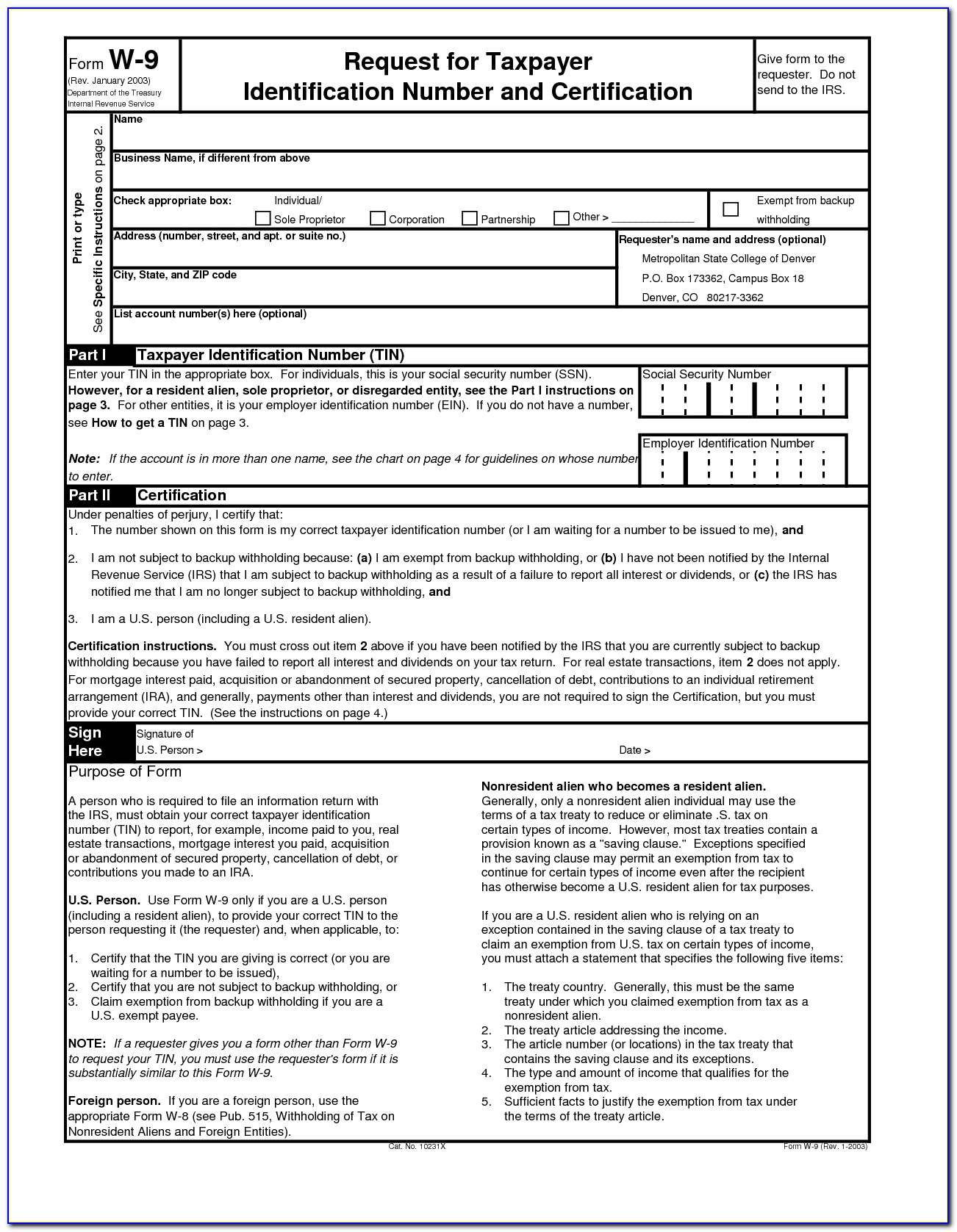

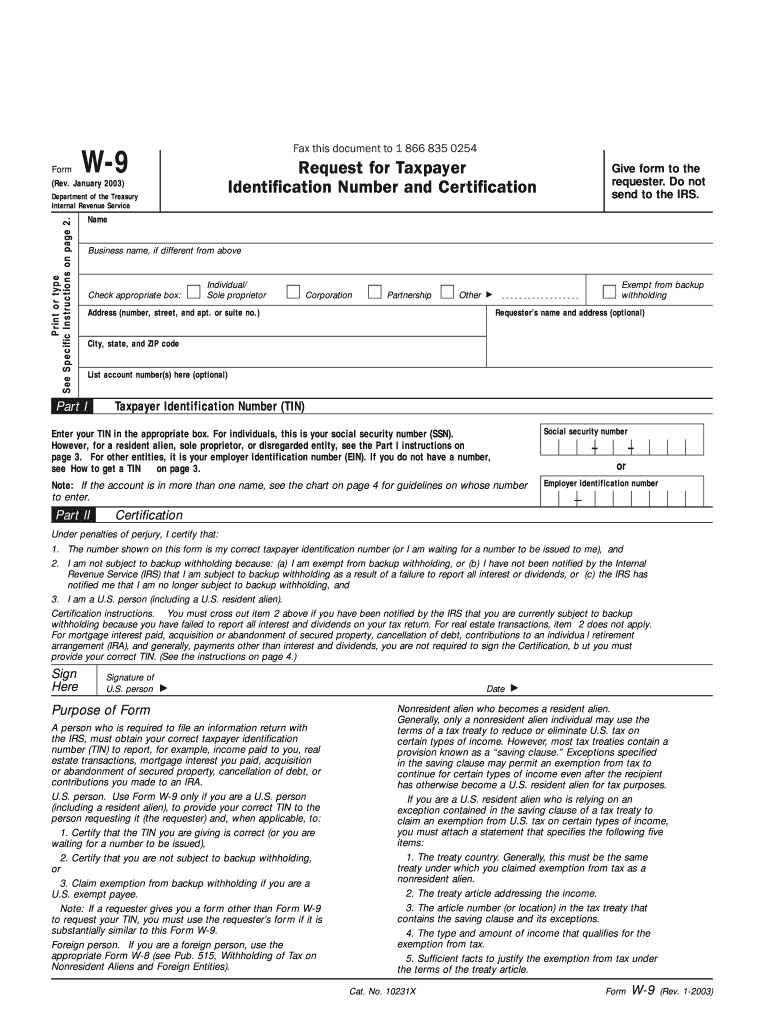

2003 Form IRS W9 Fill Online, Printable, Fillable, Blank pdfFiller

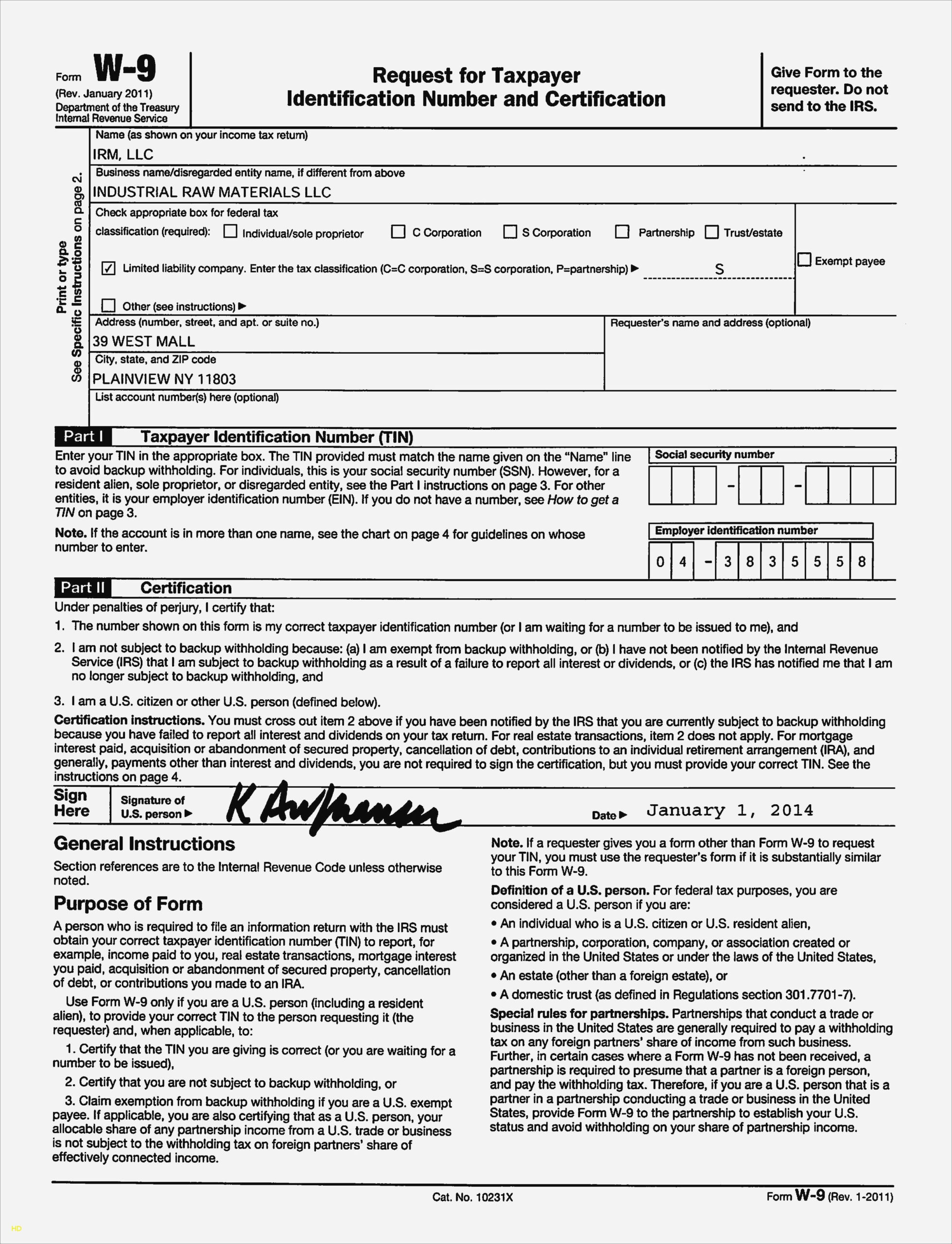

How to Submit Your W 9 Forms Pdf Free Job Application Form

Irs W 9 Form 2024 Printable Joey Rosita

Branch Of A Foreign Person That Is Treated As A U.s.

For Federal Tax Purposes, You Are Considered A U.s.

(For A Sole Proprietor Or Disregarded Entity, Enter The Owner’s Name.

Related Post: