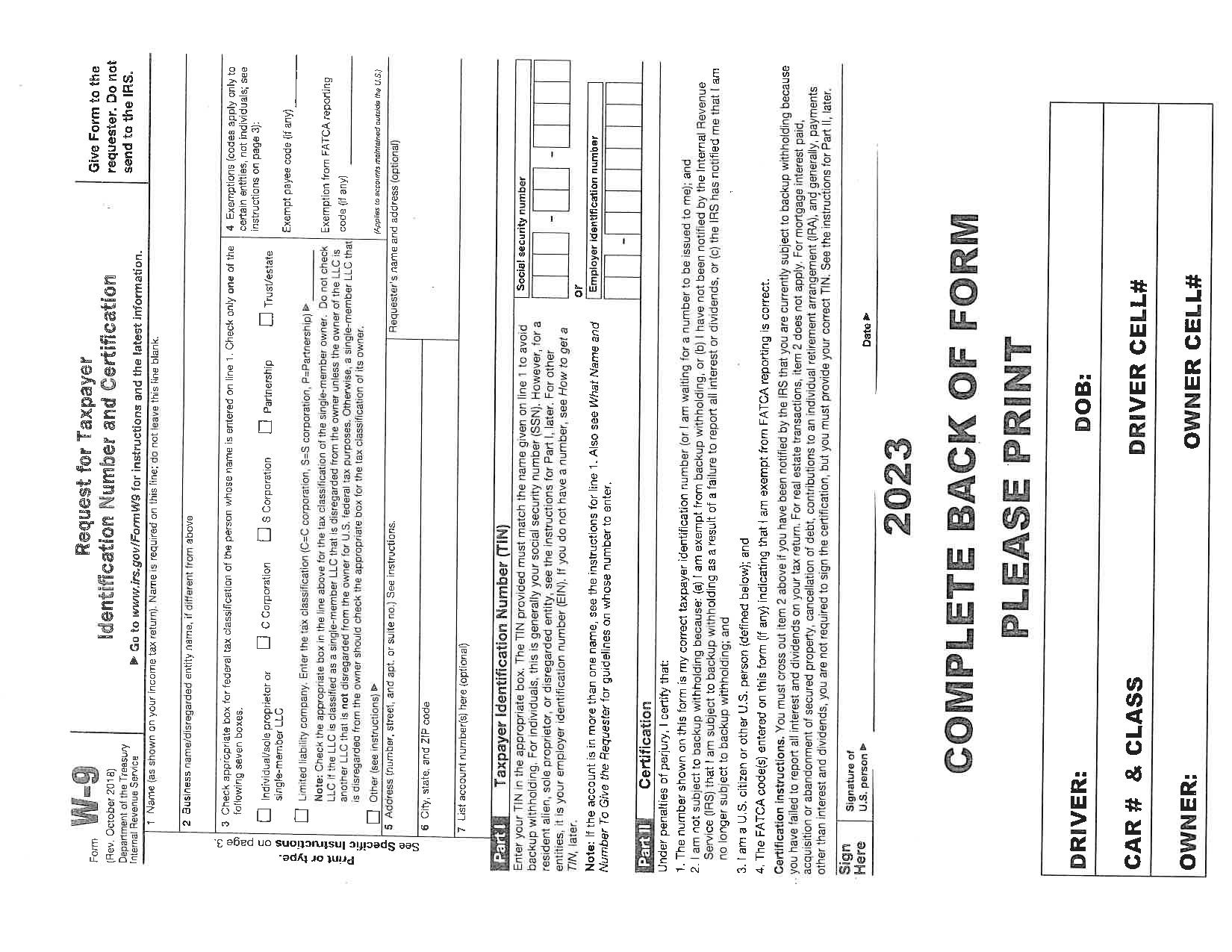

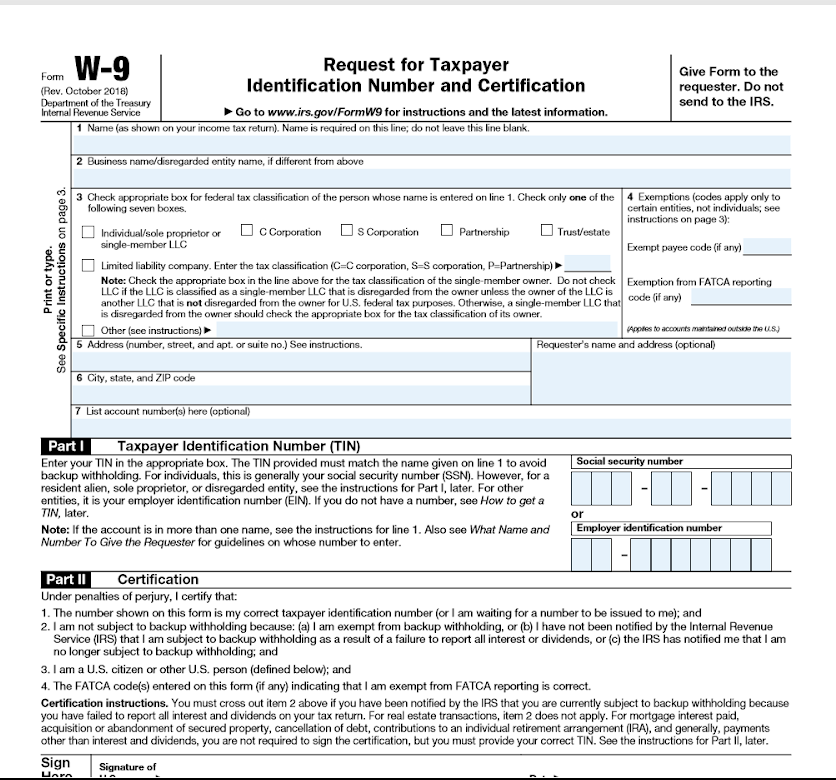

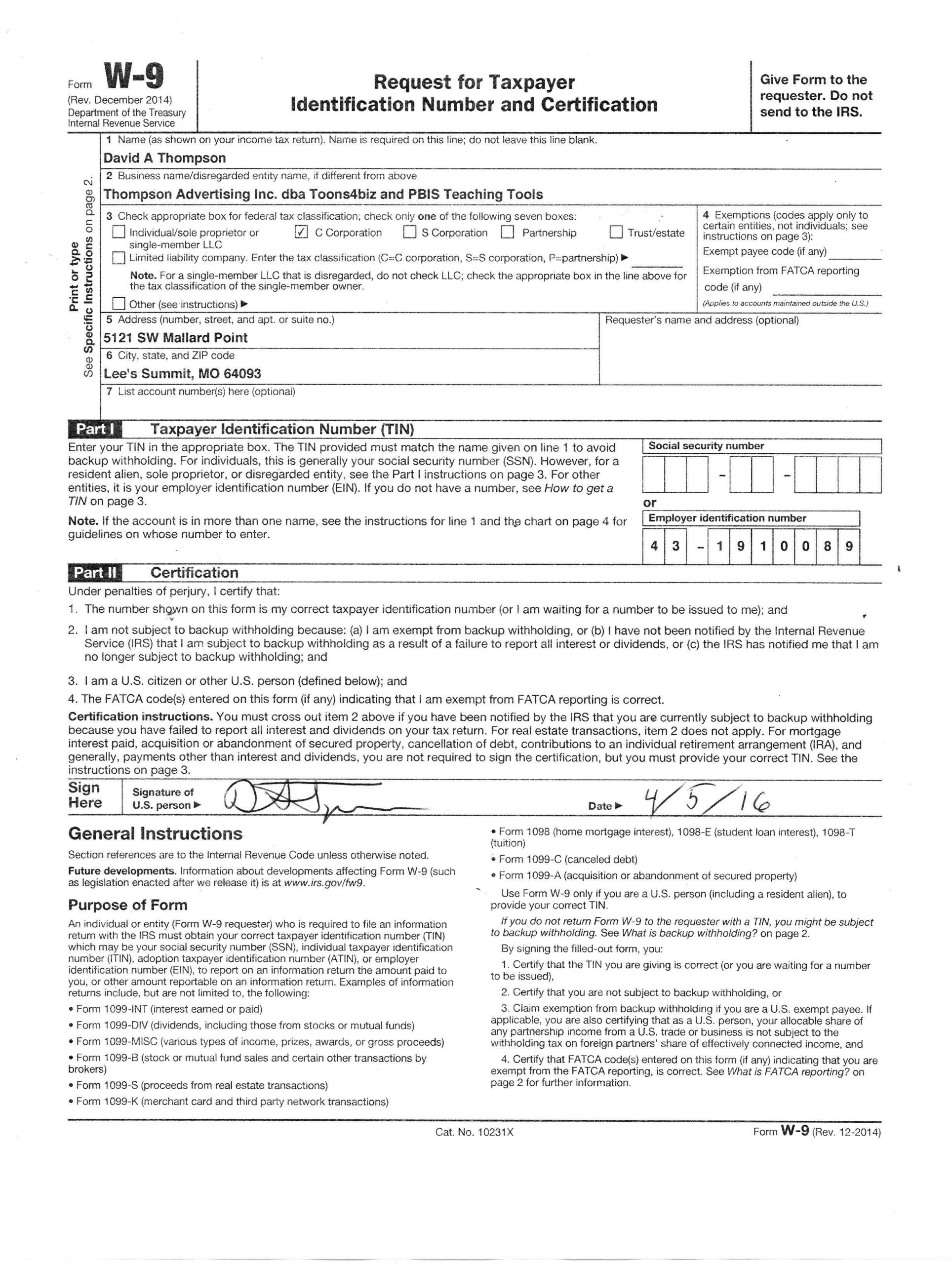

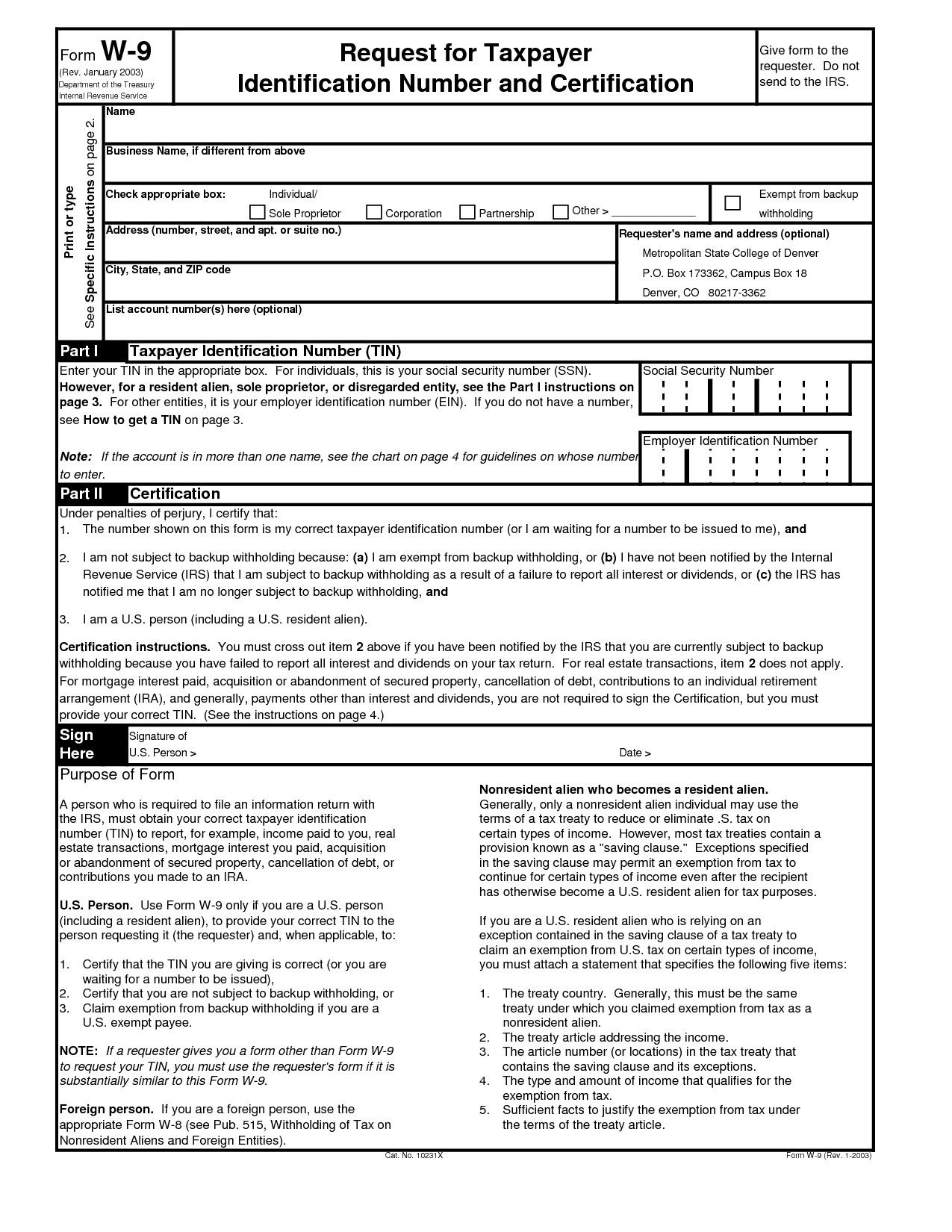

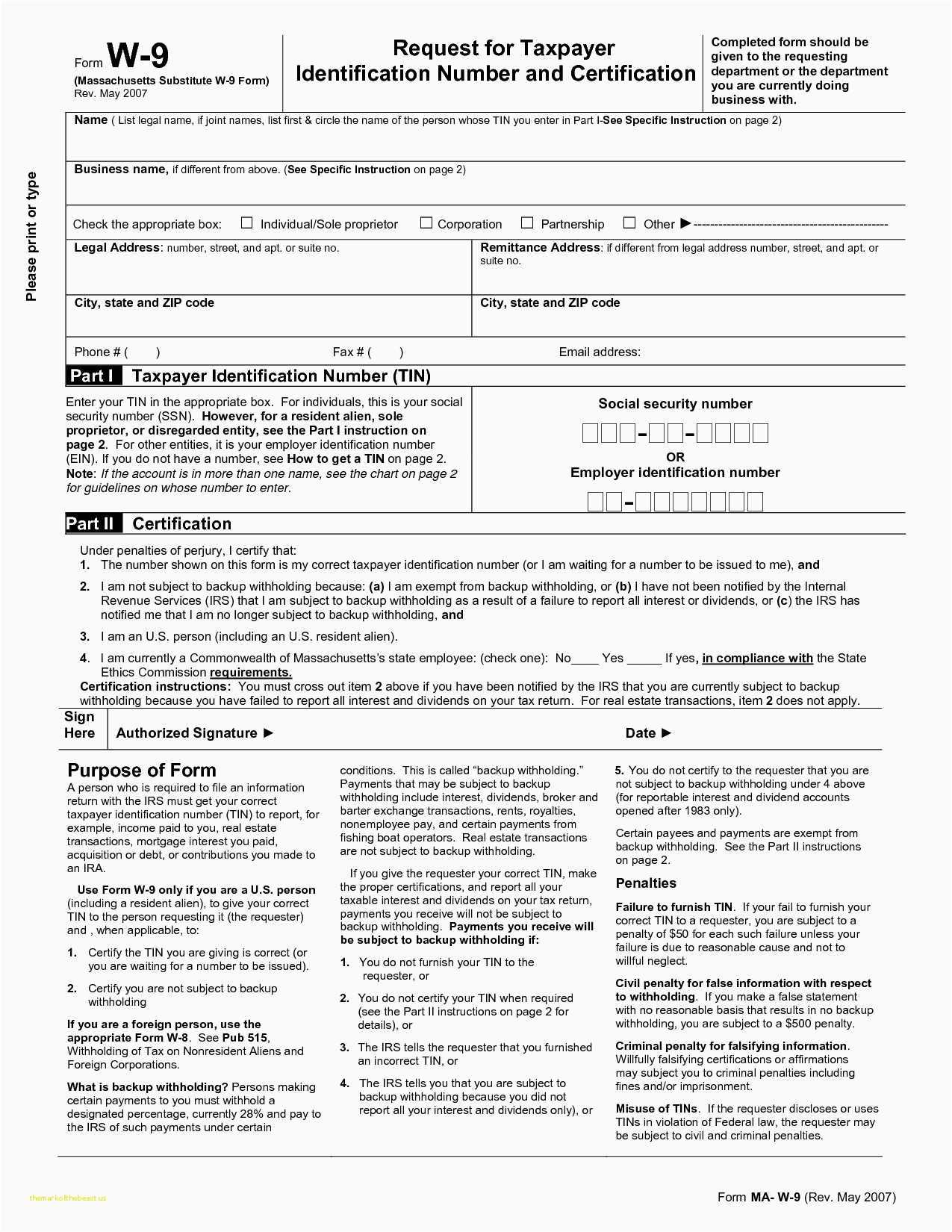

Printable W9 Forms

Printable W9 Forms - View more information about using irs forms, instructions, publications and other item files. See the instructions for form 1042 for details. Also use form 1042 to report tax withheld under chapter 4 on withholdable payments. Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide your correct tin. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: The latest versions of irs forms, instructions, and publications. Person (including a resident alien), to provide your correct tin. Certify that you are not subject to backup withholding, or 3. Person (including a resident alien), to provide your correct tin. Certify that you are not subject to backup withholding, or 3. See the instructions for form 1042 for details. Use form 1042 to report tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. The latest versions. Also use form 1042 to report tax withheld under chapter 4 on withholdable payments. Person (including a resident alien), to provide your correct tin. The latest versions of irs forms, instructions, and publications. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Use form 1042 to report tax withheld. Use form 1042 to report tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Person (including a resident alien), to provide your correct tin. Person (including. Also use form 1042 to report tax withheld under chapter 4 on withholdable payments. Use form 1042 to report tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide your. The latest versions of irs forms, instructions, and publications. Also use form 1042 to report tax withheld under chapter 4 on withholdable payments. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Person (including a resident alien), to provide your correct tin. Certify that the tin you are. Also use form 1042 to report tax withheld under chapter 4 on withholdable payments. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. See the instructions for form 1042 for details. Certify that you are not subject to backup withholding, or 3. Person (including a resident alien), to provide. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. View more information about using irs forms, instructions, publications and other item files. The latest versions of irs forms, instructions,. Use form 1042 to report tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: View more information about using irs forms, instructions, publications and other. Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide your correct tin. View more information about using irs forms, instructions, publications and other item files. Use form 1042 to report tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: See the instructions for form 1042 for details. Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide your correct tin. Use form 1042 to report tax withheld under chapter 3 on. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Certify that you are not subject to backup withholding, or 3. The latest versions of irs forms, instructions, and publications. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. See the instructions for form 1042 for details. Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide your correct tin. Also use form 1042 to report tax withheld under chapter 4 on withholdable payments.Printable W 9 Form For Word Format Printable Forms Free Online

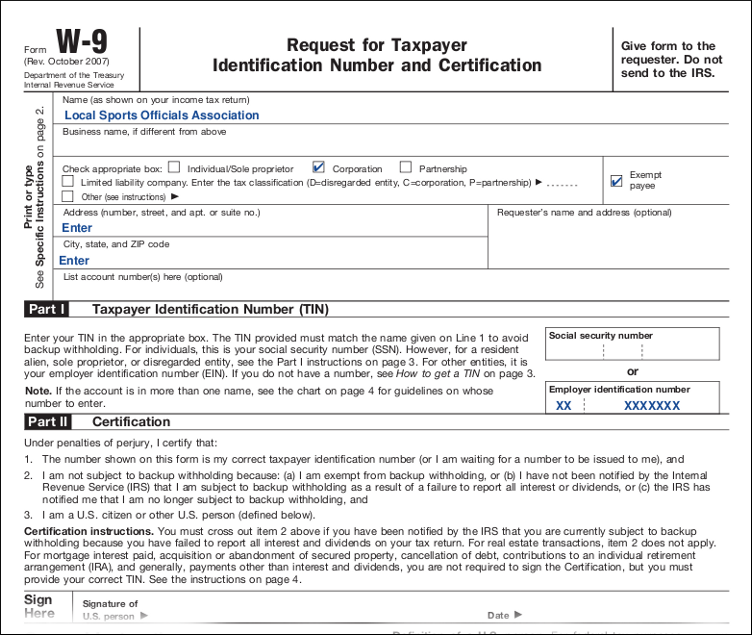

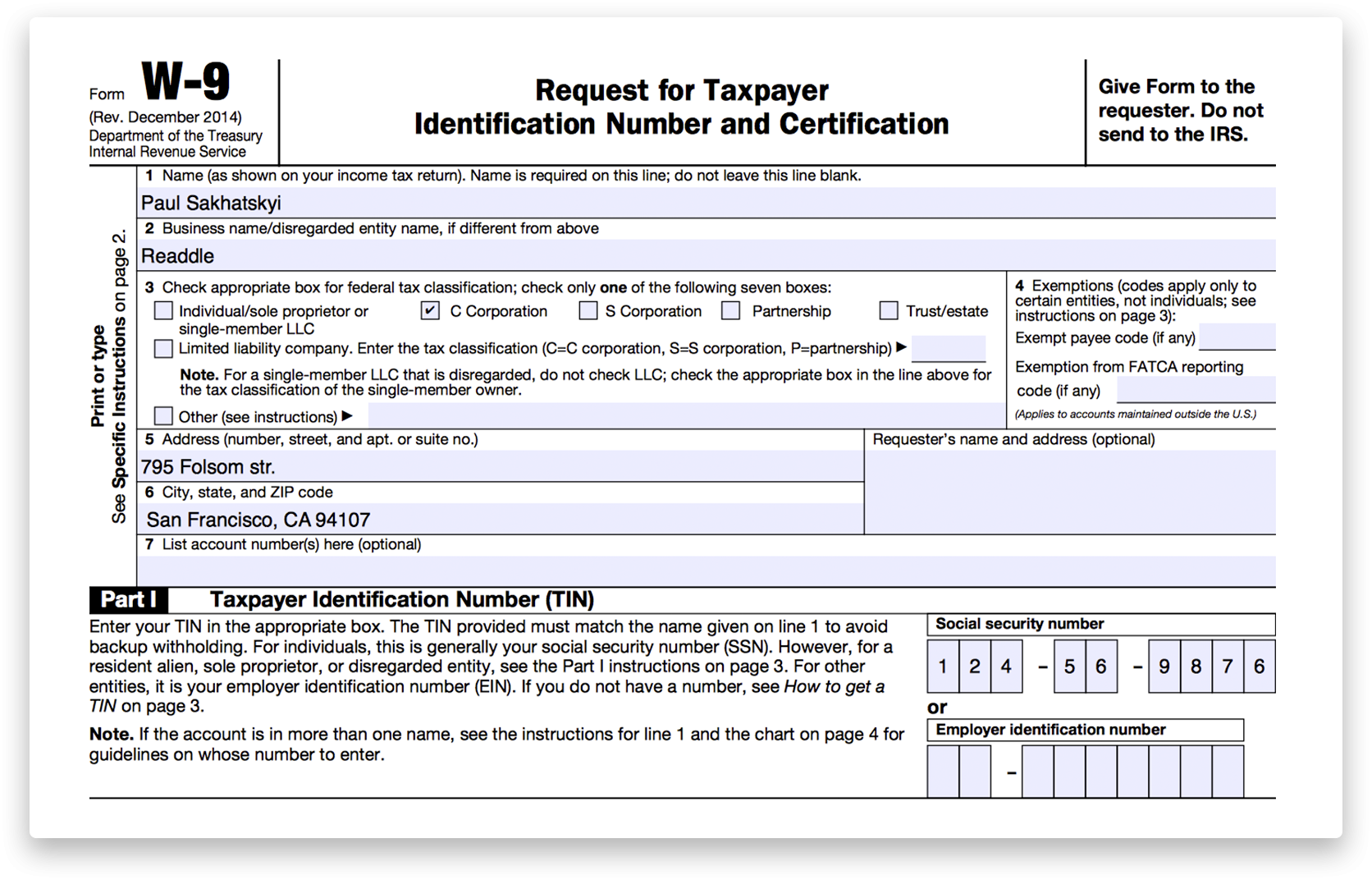

W9 Form 2024 Fillable Pdf To Arline Sheeree

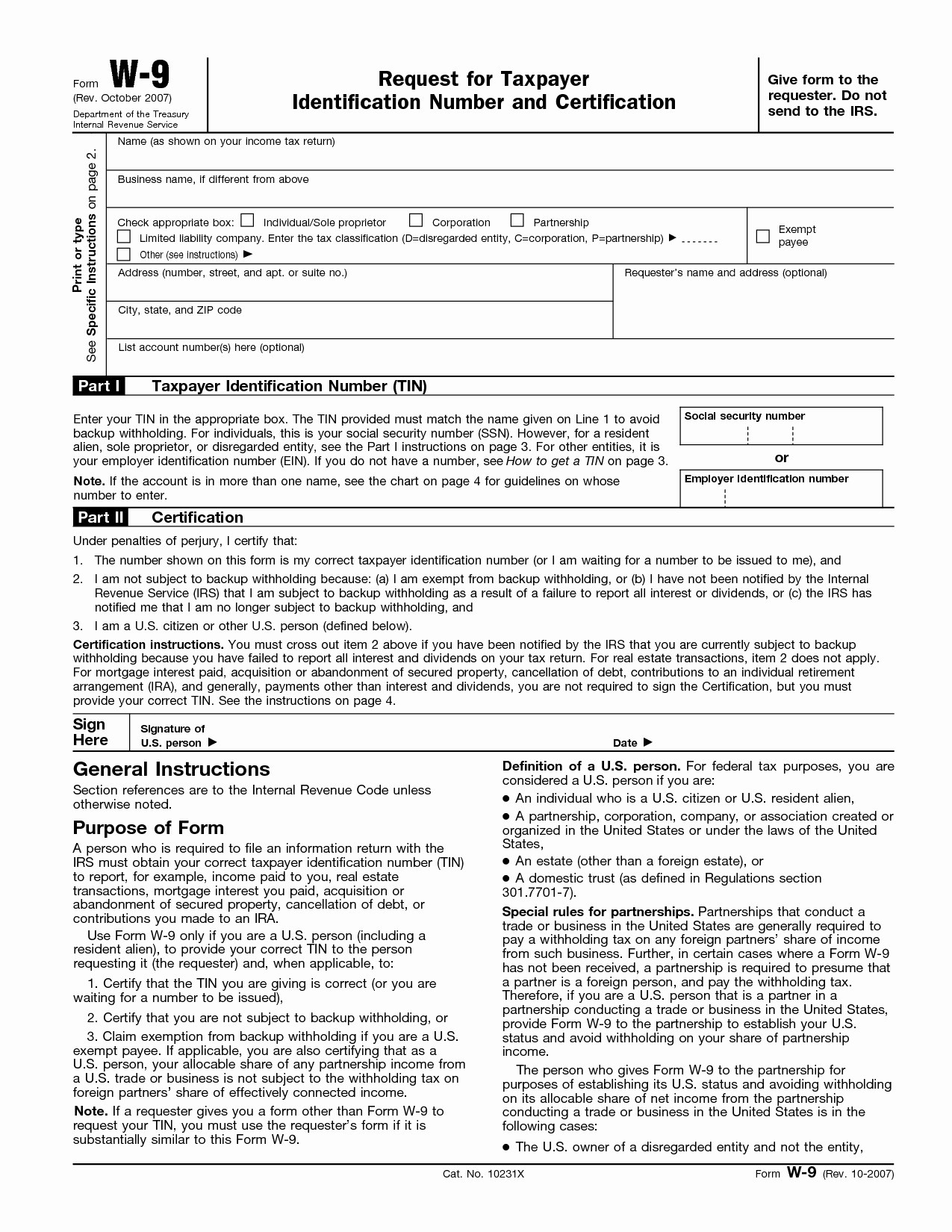

Free Printable W9 Form From Irs

Free W9 Forms 2021 Printable Pdf Calendar Printables Free Blank

Free W 9 Form Printable Calendar Printables Free Blank

Download Fillable W 9 Form Printable Forms Free Online

Free Printable W9 Forms

W9 Form Fill Out Free

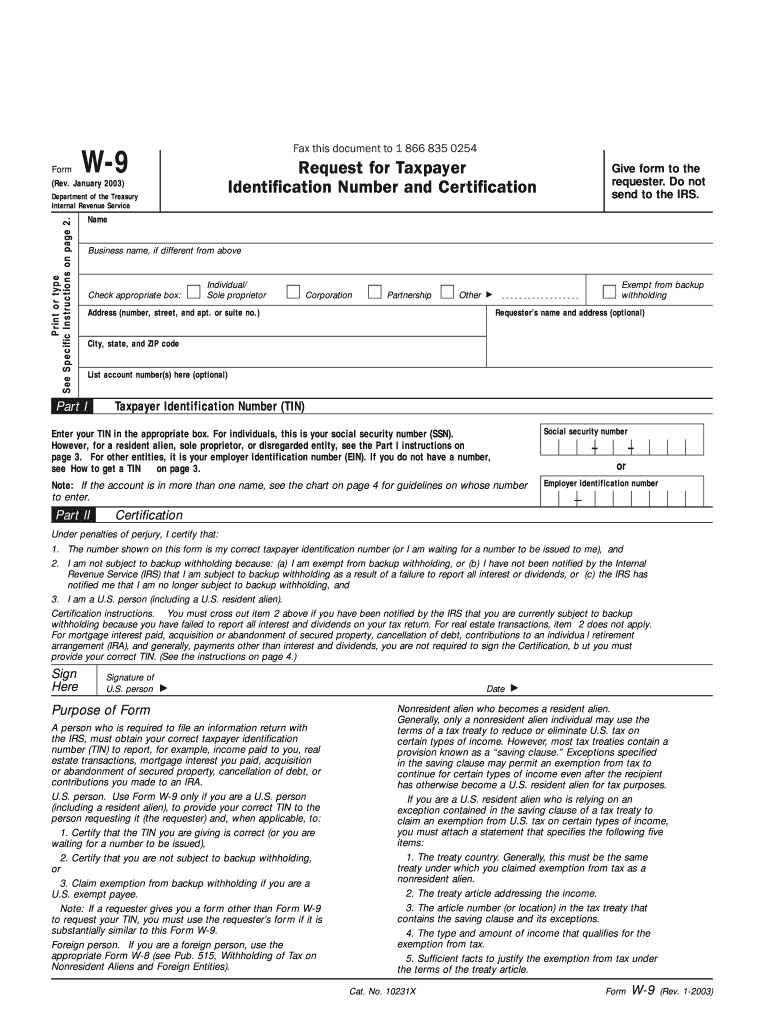

2003 Form IRS W9 Fill Online, Printable, Fillable, Blank pdfFiller

W9 Form 2019 Printable Irs W9 Tax Blank In Pdf Free Printable W9

View More Information About Using Irs Forms, Instructions, Publications And Other Item Files.

Person (Including A Resident Alien), To Provide Your Correct Tin.

Use Form 1042 To Report Tax Withheld Under Chapter 3 On Certain Income Of Foreign Persons, Including Nonresident Aliens, Foreign Partnerships, Foreign Corporations, Foreign Estates, And Foreign Trusts.

Related Post: