Printable Form 941

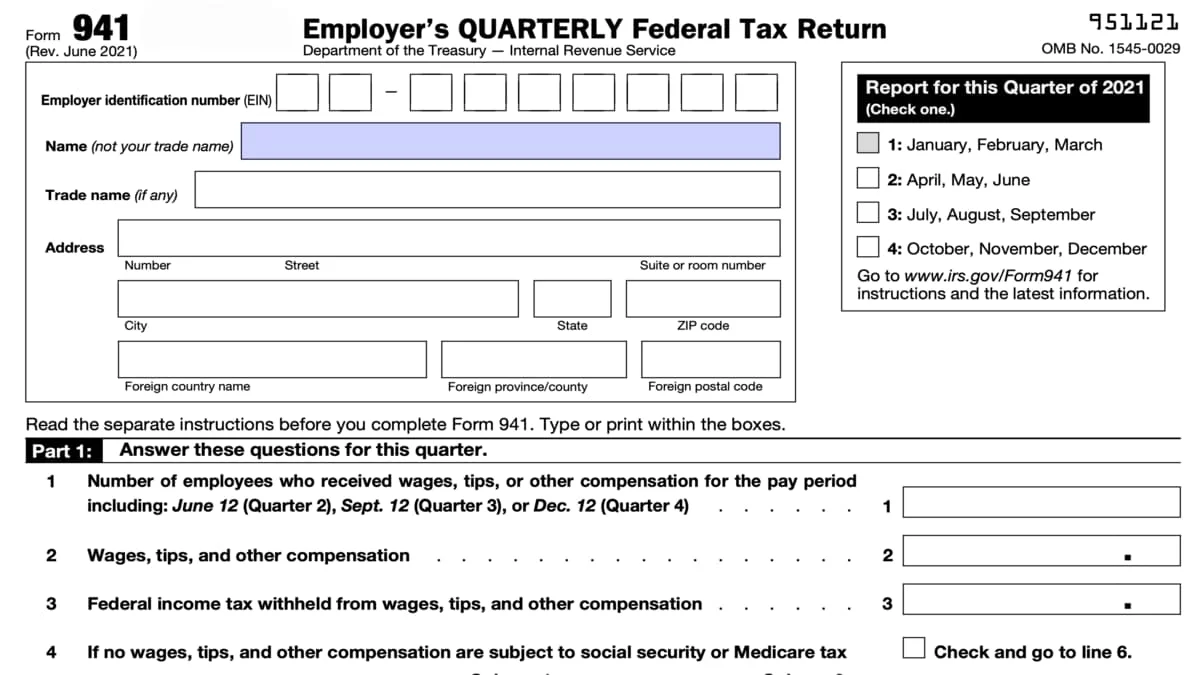

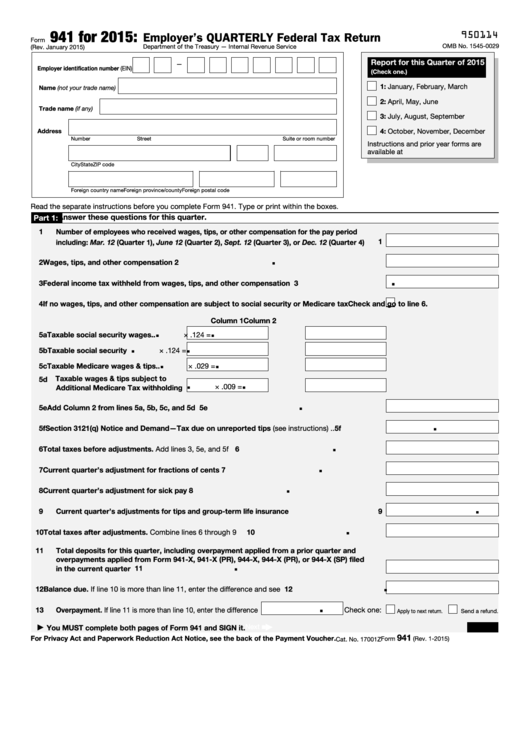

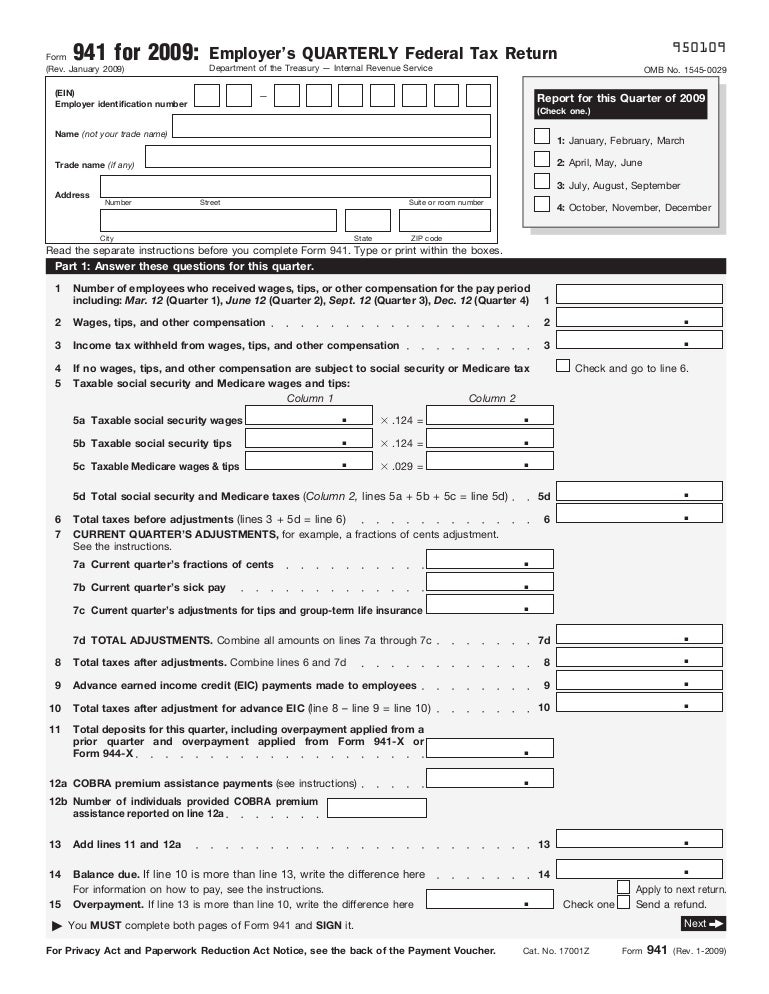

Printable Form 941 - Above is a fillable pdf version that you can print or download. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Let's look at what information is required on. Most businesses must report and file tax returns quarterly using the irs form 941. This form determines your payroll tax liability for the quarter. Read the separate instructions before you complete form 941. Form 941 employer's quarterly federal tax return. Number of employees who received wages,. Read the separate instructions before you complete form 941. Type or print within the boxes. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be. Above is. Number of employees who received wages,. Type or print within the boxes. Form 941 is used by employers who withhold. Above is a fillable pdf version that you can print or download. Type or print within the boxes. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Type or print within the boxes. Number of employees who received wages,. Answer these questions for this quarter. Wages, tips, and other compensation. Type or print within the boxes. Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be. Let's look at what information is required on. This form determines your payroll tax liability for the quarter. Type or print. Answer these questions for this quarter. Form 941 is used by employers who withhold. Answer these questions for this quarter. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Type or print within the boxes. Answer these questions for this quarter. This form determines your payroll tax liability for the quarter. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Read the separate instructions before you complete form 941. Answer these questions for this quarter. This guide provides the basics of the 941 form, instructions to help you fill it out, and where. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Irs form 941,. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Wages, tips, and other compensation. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have. Above is a fillable pdf version that you. Read the separate instructions before you complete form 941. Type or print within the boxes. Form 941 is used by employers who withhold. Read the separate instructions before you complete form 941. Number of employees who received wages,. Answer these questions for this quarter. Read the separate instructions before you complete form 941. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Read the separate instructions before you complete form 941. If you have employees, you must file form 941 to report any federal withholdings. Answer these questions for this quarter. Read the separate instructions before you complete form 941. Type or print within the boxes. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have. Answer these questions for this quarter. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Above is a fillable pdf version that you can print or download. Read the separate instructions before you complete form 941. This guide provides the basics of the 941 form, instructions to help you fill it out, and where. Type or print within the boxes. This form determines your payroll tax liability for the quarter. Most businesses must report and file tax returns quarterly using the irs form 941. If you have employees, you must file form 941 to report any federal withholdings. Number of employees who received wages,. Type or print within the boxes. Answer these questions for this quarter.941 Form 2022 Printable PDF Template

Form 941 for 20 Employer's Quarterly Federal Tax Return

How to fill out IRS form 941 20222023 PDF Expert

Irs Form Fillable And Savable And Mail Printable Forms Free Online

IRS Form 941. Employer’s QUARTERLY Federal Tax Return Forms Docs 2023

Fillable Form 941 Employer S Quarterly Federal Tax Printable Form 2022

Form 941 Employer's Quarterly Federal Tax Return Form 941 Employer…

Form 941 Employer's Quarterly Federal Tax Return

How to fill out IRS Form 941 2019 PDF Expert

Printable 941 Form 2021 Printable Form 2024

Form 941 Employer's Quarterly Federal Tax Return.

Effective For Tax Periods Beginning After December 31, 2023, The Lines Used To Claim The Credit For Qualified Sick And Family Leave Wages Have Been Removed From Form 941 Because It Would Be.

Form 941 Is Used By Employers Who Withhold.

Let's Look At What Information Is Required On.

Related Post: