Printable 1099S

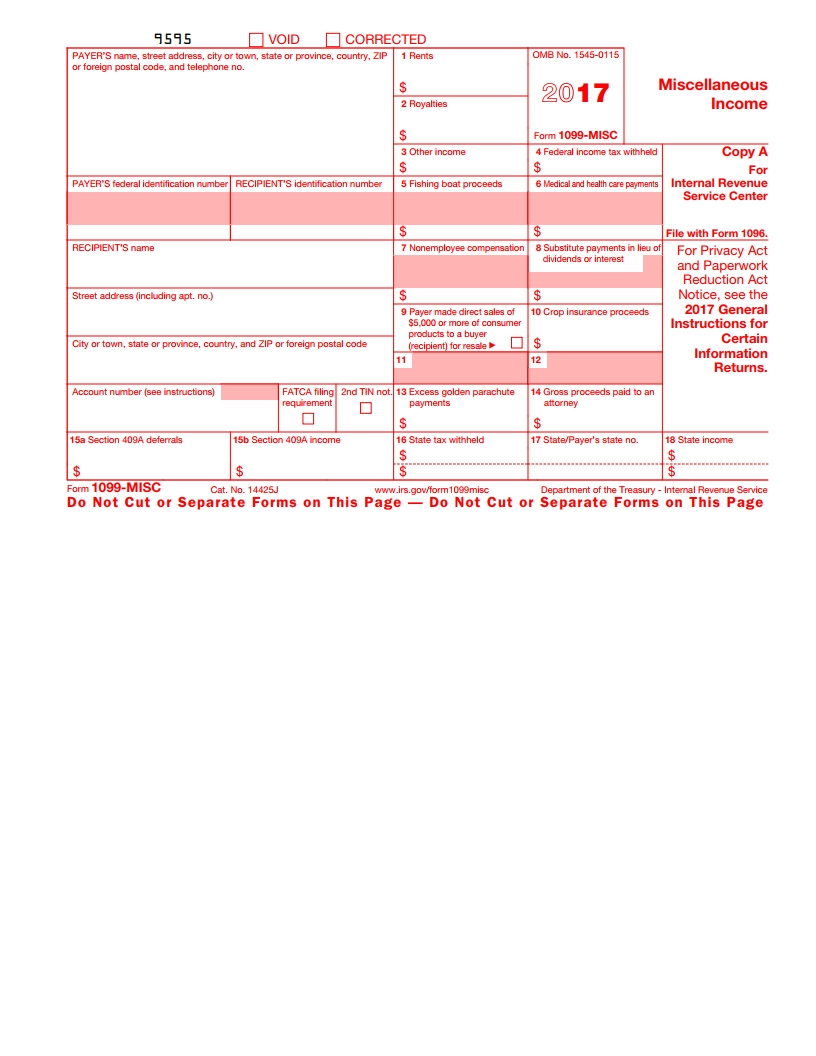

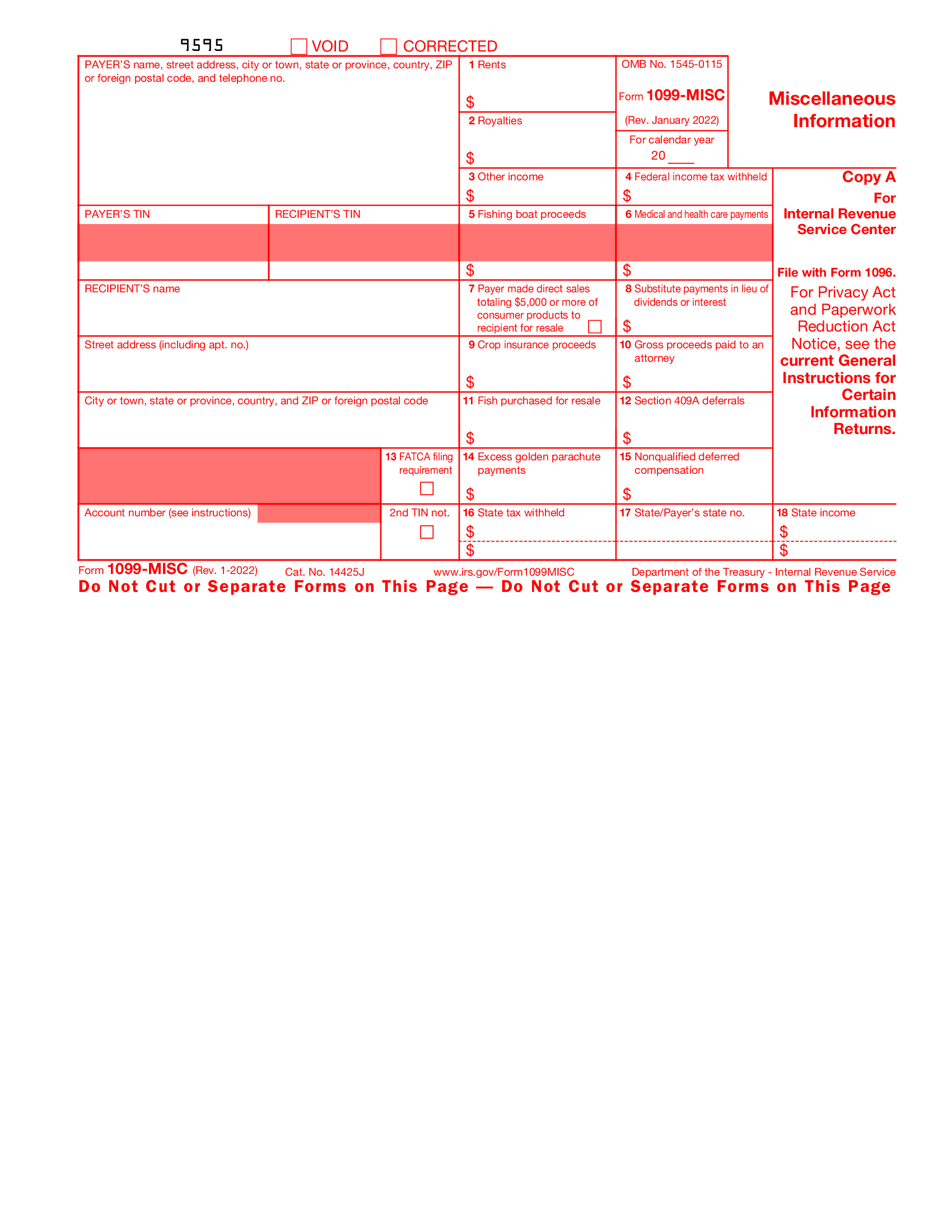

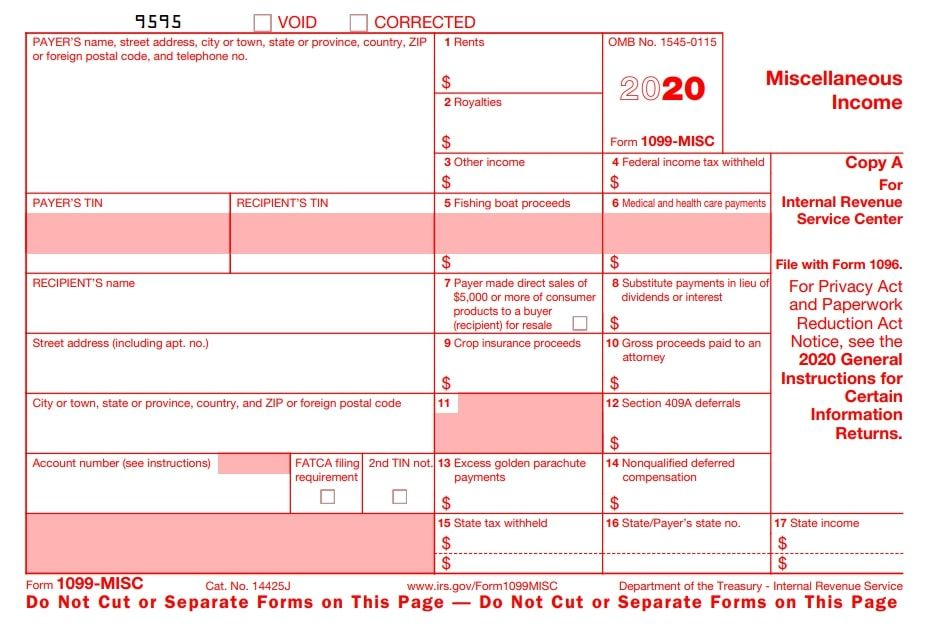

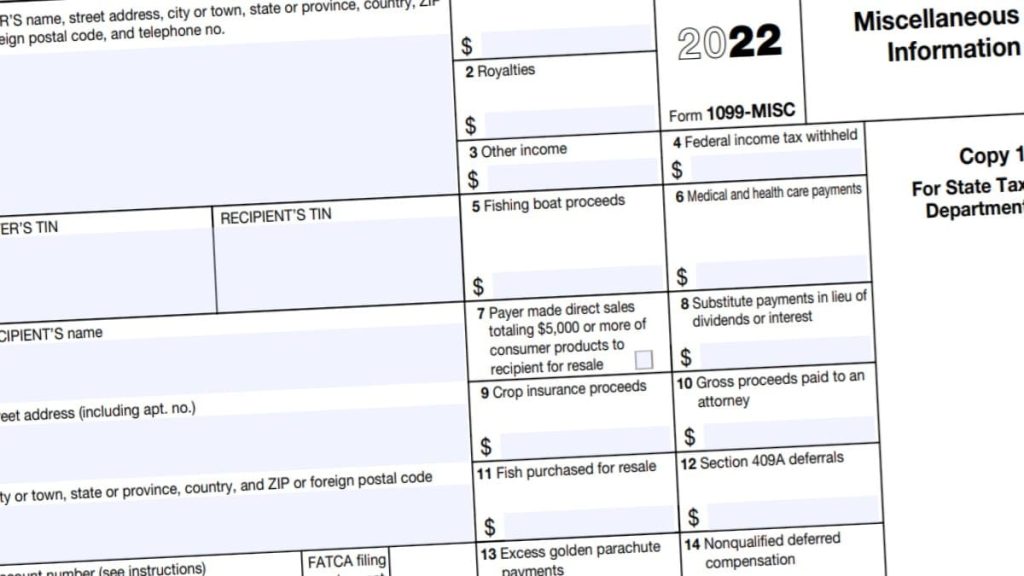

Printable 1099S - Can you print 1099s on plain paper? You can't print them on plain white paper. Persons with a hearing or speech disability with access to tty/tdd equipment can. Linking your external account can take up to 2 days. Where to order printable 1099 forms. Web updated march 20, 2024. We will select the correct number of parts based on the state you select. View solution in original post. Furnish copy b of this form to the transferor You can print 1099's from quickbooks online by following the instructions below: December 10, 2018 09:32 pm. Go to taxes then select 1099 filings. Specify the date range, then choose ok. Web page last reviewed or updated: January 17, 2019 02:08 pm. Web print and file copy a downloaded from this website; Print your 1099 and 1096 forms. Find out how to print and order 1099 forms. View solution in original post. January 2022) proceeds from real estate transactions. Select view 1099 to view a. Can you print 1099s on plain paper? When complete, choose the print and mail instead option. To order these instructions and additional forms, go to. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. 2024 tax forms go on sale june 1st. You can also refer to this article: Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. January 17, 2019 02:08 pm. When should you print and send your. Select view 1099 to view a. January 17, 2019 02:08 pm. Section references are to the internal revenue code unless otherwise noted. View solution in original post. We will select the correct number of parts based on the state you select. January 17, 2019 02:08 pm. Web print and file copy a downloaded from this website; Web register your online savings account after you receive your confirmation email (within minutes of applying). The payer fills out the 1099 and sends copies to you and the irs. Specify the date range, then choose ok. How to print 1099s from a pdf. Confirm your printer settings, then hit print. Tap the print 1099 button. January 17, 2019 02:08 pm. Web choose prepare 1099s. See list of parts required for each state. January 17, 2019 02:08 pm. To order these instructions and additional forms, go to. See part o in the current general instructions for certain information returns, available at irs.gov/form1099, for more information about penalties. Web page last reviewed or updated: The list of payments that require a business to file a. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Confirm your printer settings, then hit print. You can print 1099's from quickbooks online by following the instructions below: Web choose prepare 1099s. You can't print them on plain white paper. Persons with a hearing or speech disability with access to tty/tdd equipment can. Tap the print 1099 button. Confirm your printer settings, then hit print. When should you print and send your 1099s? I've got your back, @rhondaabc. Where to order printable 1099 forms. You can print 1099's from quickbooks online by following the instructions below: Medical and health care payments. How to print 1099s from quickbooks. The payer fills out the 1099 and sends copies to you and the irs. To order these instructions and additional forms, go to. We will select the correct number of parts based on the state you select. Specify the date range, then choose ok. Each depositor is insured to at least $250,000 per depositor, per insured bank, per ownership category. See part o in the current general instructions for certain information returns, available at irs.gov/form1099, for more information about penalties.1099 S Fillable Form Printable Forms Free Online

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

Fillable 1099 Misc Irs 2022 Fillable Form 2024

Printable 1099s 2021 Form Printable Form 2024

Fillable 1099 Misc Irs 2023 Fillable Form 2023

What is a 1099Misc Form? Financial Strategy Center

Printable 1099 Form Pdf Free Printable Download

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

How to Fill Out 1099 MISC IRS Red Forms

See List Of Parts Required For Each State.

Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Print Your 1099 And 1096 Forms.

How To Print 1099S From A Spreadsheet.

Related Post: