Irs Form 433 D Printable

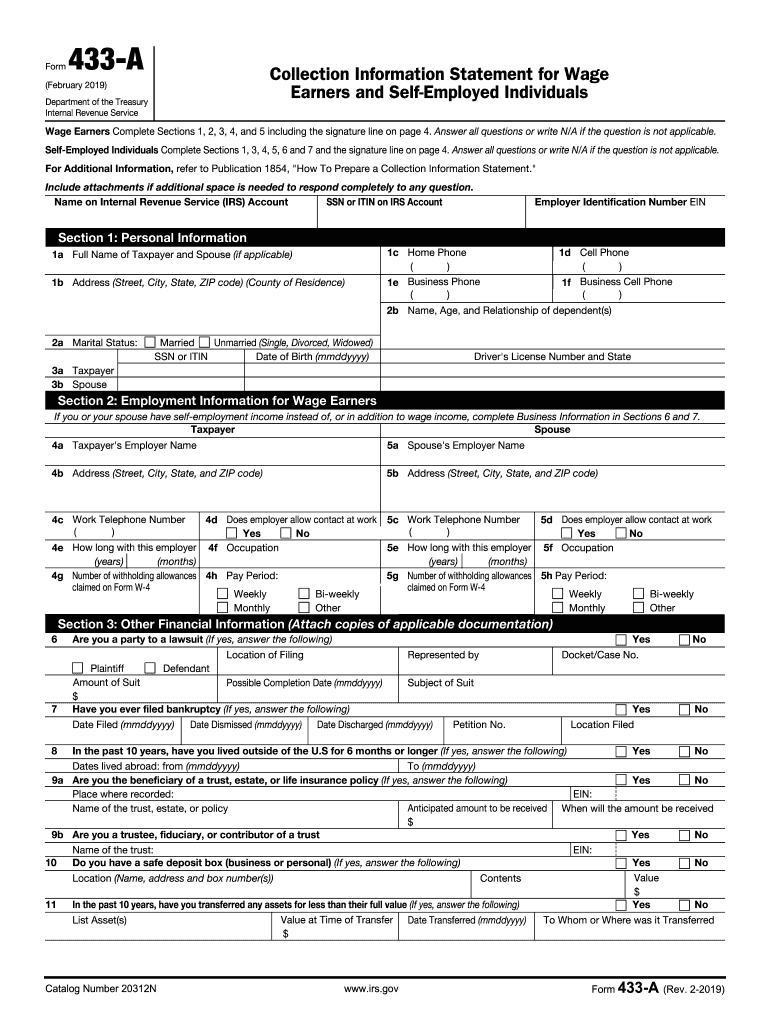

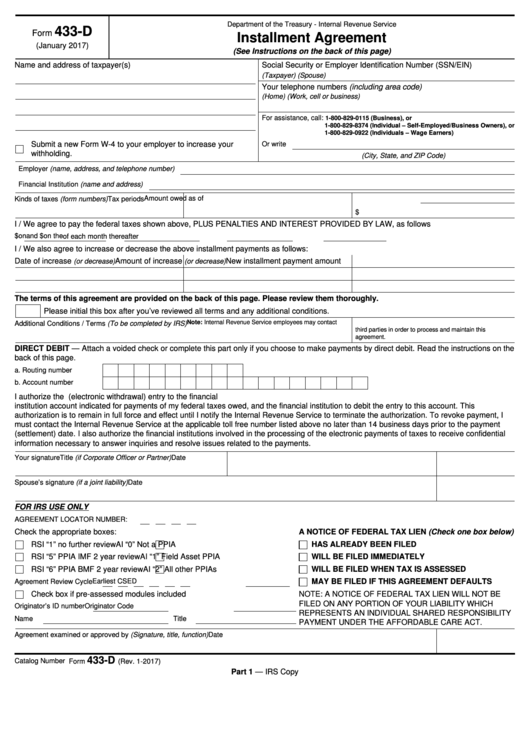

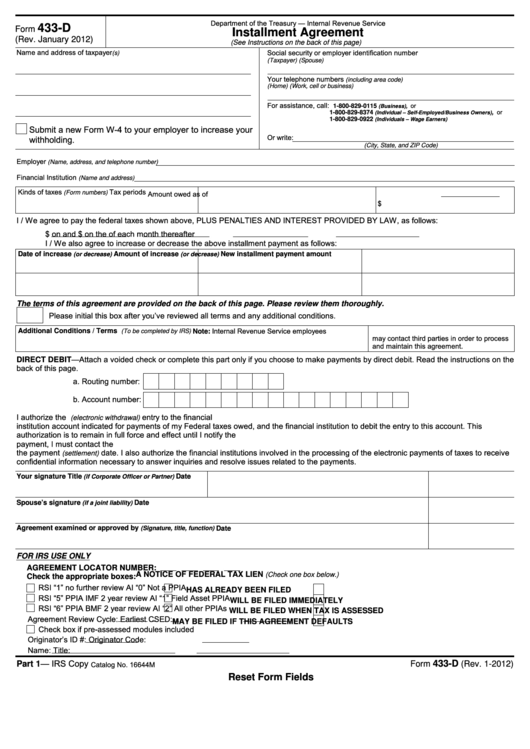

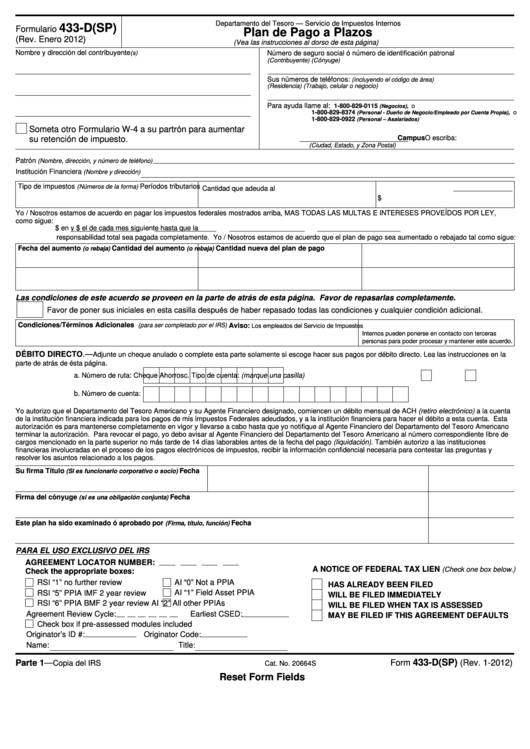

Irs Form 433 D Printable - Go to www.irs.gov/scheduled for instructions and the latest information. Use this form if you are an individual who owes income tax on a form 1040, u.s. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit. The document finalizes the agreement between an individual or a business and the irs. Follow the simple instructions below: Web get your online template and fill it in using progressive features. To find it, go to the app store and type signnow in the search field. Tax professionals have to deal with massive amounts of data in various paper and electronic formats. Use the cross or check marks in the top toolbar to select your answers in the list boxes. However, you need a form 9465 from the irs to initiate the tax resolution. Use get form or simply click on the template preview to open it in the editor. Web the document you are trying to load requires adobe reader 8 or higher. • your name (include spouse’s name if a. If address provided above is different than last return filed, please check here county of residence. You may not have the adobe. Your social security number or individual taxpayer identification. Tax professionals have to deal with massive amounts of data in various paper and electronic formats. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Signnow has paid close attention to ios users and developed an application just for them. Use form 8949. Use get form or simply click on the template preview to open it in the editor. Printable irs form 433 d. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit. Web the document you are trying to load requires adobe reader 8 or higher. Basic information this includes your name,. Go to www.irs.gov/scheduled for instructions and the latest information. Web about schedule d (form 1040), capital gains and losses use schedule d (form 1040) to report the following: Difference between tax forms basic conditions instructions for compiling the form purposes and objectives Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or. Use this form if you are an individual who owes income tax on a form 1040, u.s. The document finalizes the agreement between an individual or a business and the irs. Tax professionals have to deal with massive amounts of data in various paper and electronic formats. Individual income tax return an individual with a personal liability for. You may. You may not have the adobe reader installed or your viewing environment may not be properly. If address provided above is different than last return filed, please check here county of residence. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Web about schedule d (form 1040), capital gains and losses use schedule d (form 1040) to report the following: Difference between tax forms basic conditions instructions for compiling the form purposes and objectives The document finalizes the agreement between an individual or a business and the irs. Signnow has paid close attention to ios users and developed an application just for them. • your name (include spouse’s name if a. Web the document you are trying to load requires adobe reader 8 or higher. Start completing the fillable fields and carefully type in required information. Your social security number or individual taxpayer identification. Social security number or employer identification number (ssn/ein) telephone numbers; Basic information this includes your name, address, phone number, and social security number. Individual income tax return an individual with a personal liability for. To find it, go to the app store and type signnow in the search field. Go to www.irs.gov/scheduled for instructions and the latest information.Irs Form 433 D Printable

Fillable Form 433D Installment Agreement printable pdf download

Fillable Form 433D Installment Agreement printable pdf download

Fillable Formulario 433D(Sp) Plan De Pago A Plazos printable pdf

IRS Form 433D Fill out, Edit & Print Instantly

Web Get Your Online Template And Fill It In Using Progressive Features.

Enjoy Smart Fillable Fields And Interactivity.

Printable Irs Form 433 D.

Use The Cross Or Check Marks In The Top Toolbar To Select Your Answers In The List Boxes.

Related Post: