Form W 4V Printable

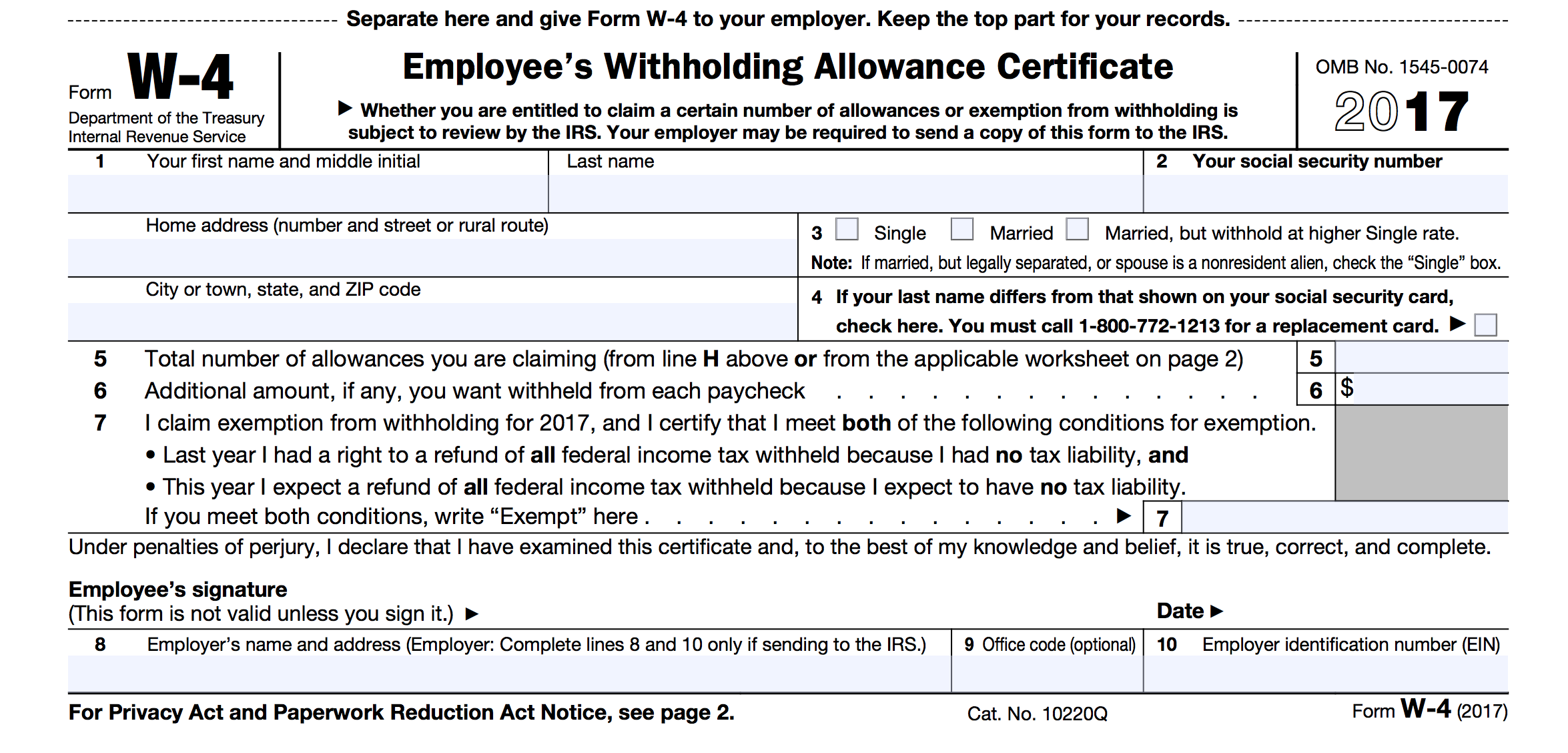

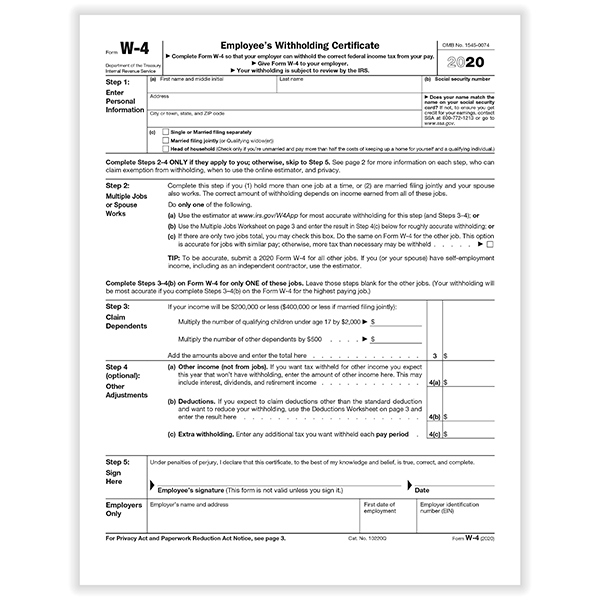

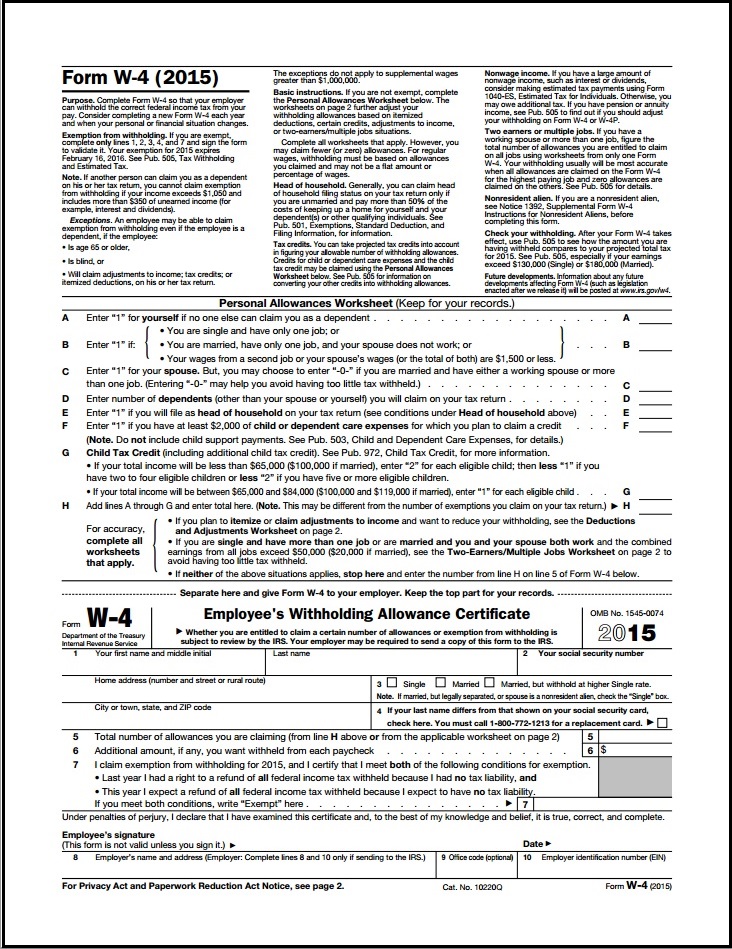

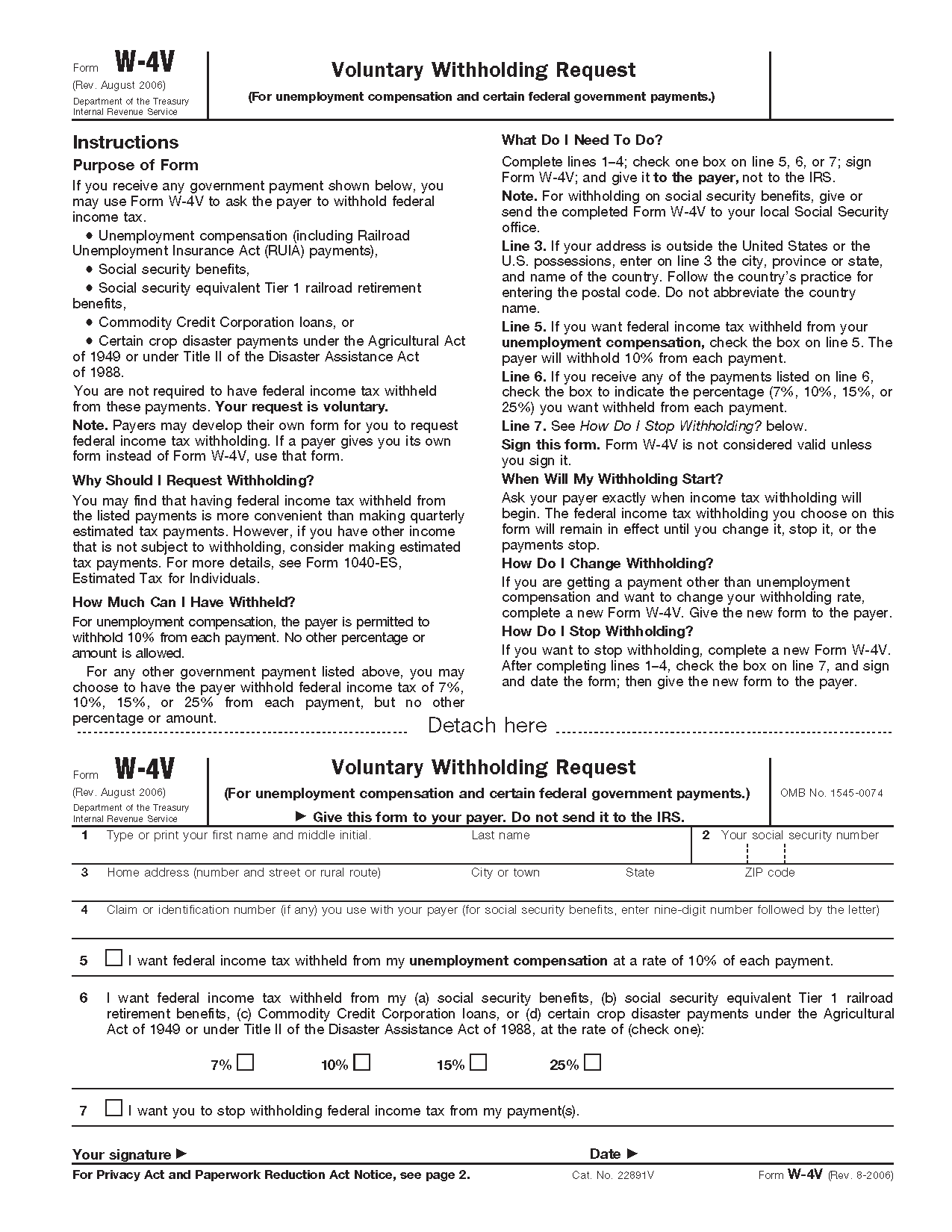

Form W 4V Printable - Enter your official identification and contact details. Edit your w 4v online type text, add images, blackout confidential details, add comments, highlights and more. After that, your form w 4v is completed. Web open the form in the online editing tool. Look through the instructions to learn which information you need to include. The form helps employers determine how much federal income tax to withhold from employees' paychecks. Web the form you are looking for is not available online. Do not send it to the irs. Congrats on the new job! Employees must fill out the form every year and submit it to their employer. The form helps employers determine how much federal income tax to withhold from employees' paychecks. Edit your w 4v online type text, add images, blackout confidential details, add comments, highlights and more. You can also download it, export it or print it out. Web the form you are looking for is not available online. Sign it in a few clicks. Choose what kind of esignature to generate. Web the w 4v form is an internal revenue service (irs) form that employees use to report their wages, withholding allowances, and tax status. If you receive any government payment shown below, you may use this form to ask the payer to withhold federal income tax. Complete lines 1 to 4 of the. Sign online button or tick the preview image of the document. Skip lines 5 and 6 on the 2019 w4 form and complete line 7. Web the form you are looking for is not available online. Unemployment compensation (including railroad unemployment insurance act (ruia) payments), social security benefits, social security equivalent tier. Hit the my signature button. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Web the w 4v form is an internal revenue service (irs) form that employees use to. Find office address for support completing this task call us available in most u.s. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Choose what. After that, your form w 4v is completed. Web find the form you wish to sign and click upload. The form helps employers determine how much federal income tax to withhold from employees' paychecks. Fill out the personal allowances worksheet (page 3) While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. Many forms must be completed only by a social security representative. Web the w 4v form is an internal revenue service (irs) form that employees use to report their wages, withholding allowances, and tax status. Congrats on the new job! Hit the my signature button. To start the document, use the fill camp; Enter your official identification and contact details. Choose what kind of esignature to generate. Choose the fillable fields and include the requested information. Hit the my signature button. If you receive any government payment shown below, you may use this form to ask the payer to withhold federal income tax. To start the document, use the fill camp; While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Complete lines 1 to 4 of the 2019. Voluntary withholding request from the irs' website. Web the form you are looking for is not available online. Web the w 4v form is an internal revenue service (irs) form that employees use to report their wages, withholding allowances, and tax status. Enter your official identification and contact details. The form helps employers determine how much federal income tax to. Edit your w 4v online type text, add images, blackout confidential details, add comments, highlights and more. This document is usually used for the. The advanced tools of the editor will lead you through the editable pdf template. Congrats on the new job! Unemployment compensation (including railroad unemployment insurance act (ruia) payments), social security benefits, social security equivalent tier. Choose the fillable fields and include the requested information. Choose what kind of esignature to generate. Sign online button or tick the preview image of the document. A typed, drawn or uploaded esignature. You can print other federal tax. Do not send it to the irs. After that, your form w 4v is completed. Web send form w 4v via email, link, or fax. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. If you receive any government payment shown below, you may use this form to ask the payer to withhold federal income tax. Web the w 4v form is an internal revenue service (irs) form that employees use to report their wages, withholding allowances, and tax status.Irs Form W4V Printable Fillable Form W 4v Voluntary Withholding

w4v Fill out & sign online DocHub

Irs Form W4V Printable 2010 Form IRS 8825 Fill Online, Printable

Irs Form W4V Printable Form W 4 Wikipedia / It's a form that advises

Irs Form W4V Printable W4v Printable 2019 cptcode.se

IRS Form W 4v 2022 W4 Form

Form W4V Voluntary Withholding Request (2014) Free Download

Irs Form W4V Printable / Fillable Form W 8ben E Certificate Of Status

Taxes From A To Z 2020 V Is For Voluntary Withholding Taxgirl · Tax

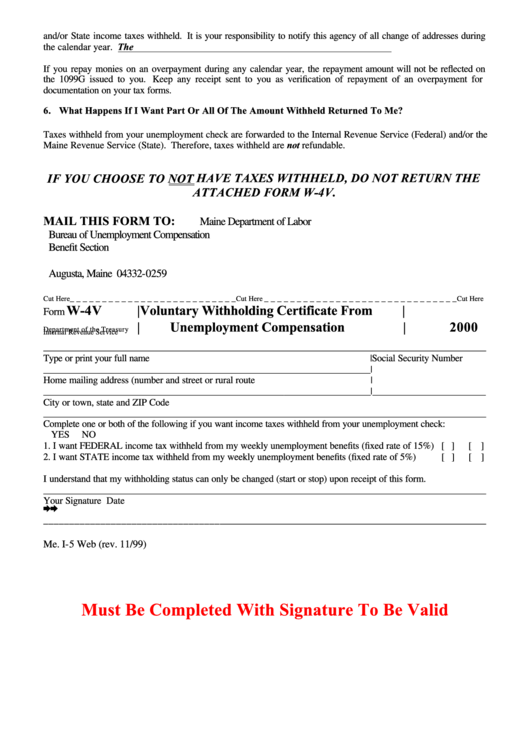

Form W4v Voluntary Withholding Certificate From Unemployment

Hit The My Signature Button.

The Form Helps Employers Determine How Much Federal Income Tax To Withhold From Employees' Paychecks.

To Start The Document, Use The Fill Camp;

You Can Also Download It, Export It Or Print It Out.

Related Post: