8.25 Sales Tax Chart Printable

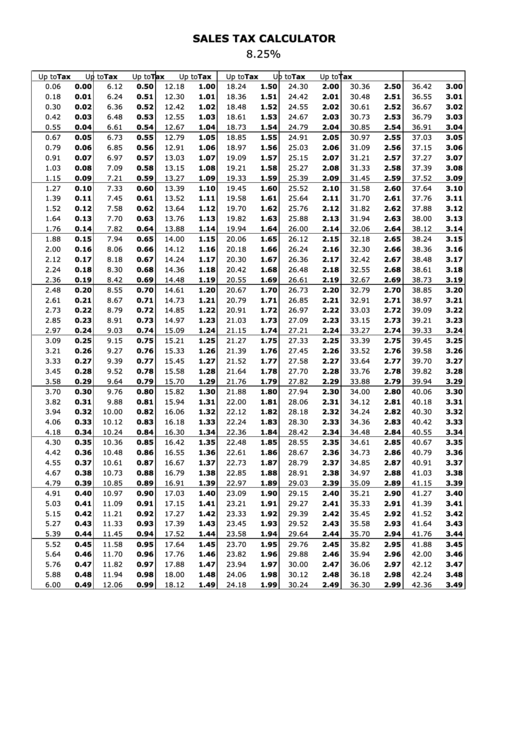

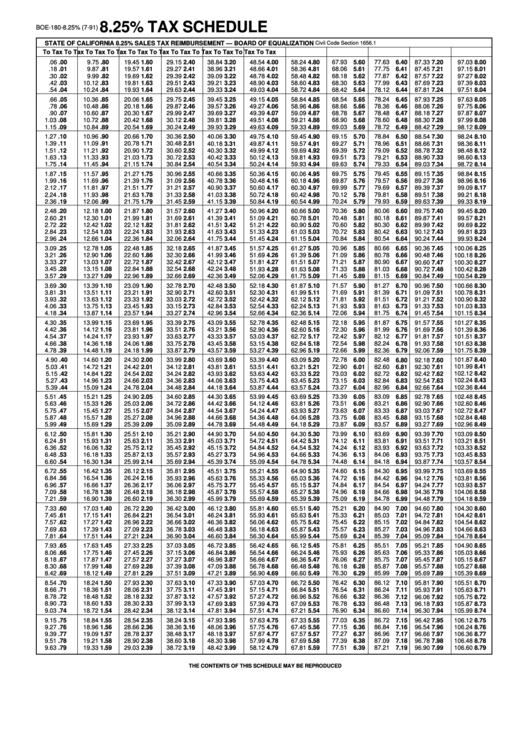

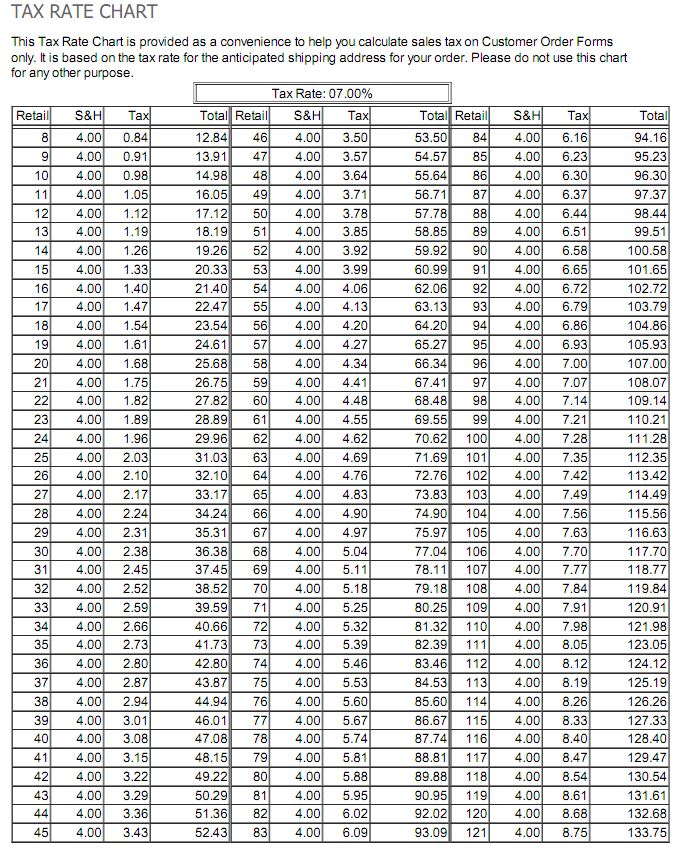

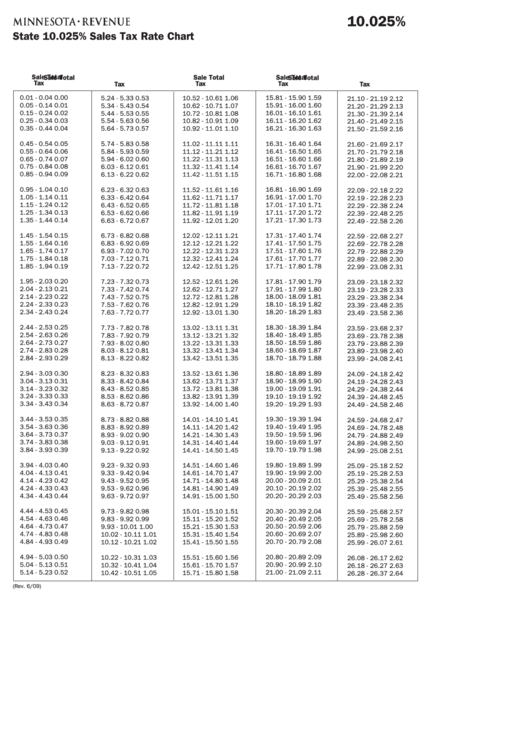

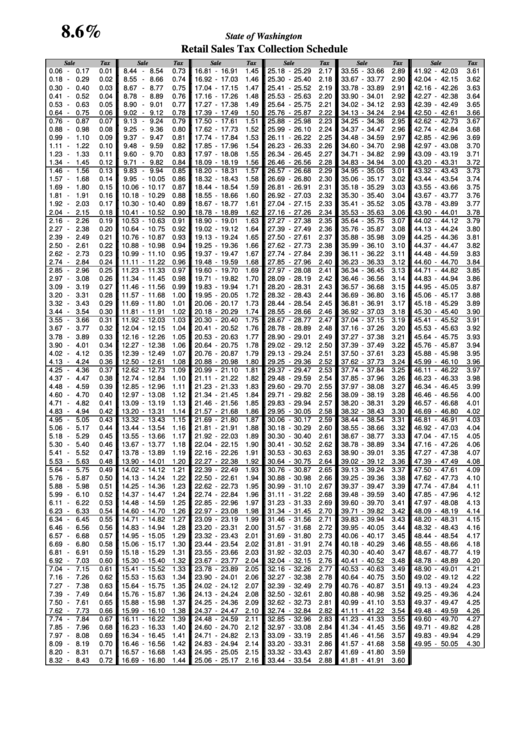

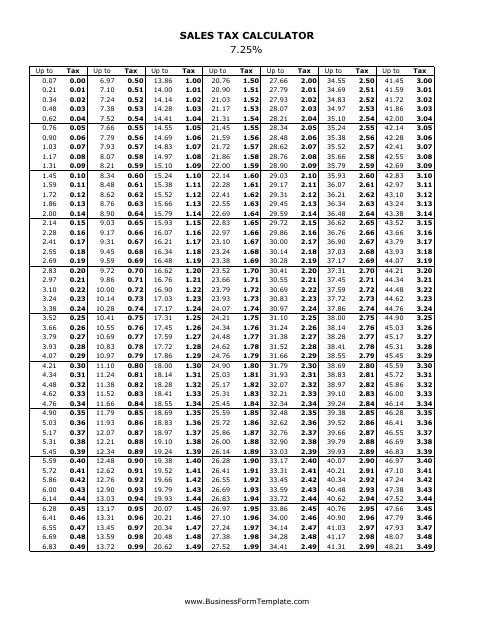

8.25 Sales Tax Chart Printable - Sales tax is one of these. Web 8.25% sales tax calculator online. To use this chart, locate the row that contains the purchase price. Town of corte madera 9.00%. City of san rafael 9.25%. Town of san anselmo 9.25%. Web divide tax percentage by 100: Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. 70 + 4.55 = $74.55 sales tax calculation formulas sales tax rate = sales tax percent / 100 sales tax = list price * sales tax rate Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. Web 8.25% sales tax calculator online. 6.5 / 100 = 0.065 multiply price by decimal. Town of san anselmo 9.25%. 70 + 4.55 = $74.55 sales tax calculation formulas sales tax rate = sales tax percent / 100 sales tax = list price * sales tax rate These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. 70 * 0.065 = 4.55 you will pay $4.55. 70 + 4.55 = $74.55 sales tax calculation formulas sales tax rate = sales tax percent / 100 sales tax = list price * sales tax rate Transactions between companies are not subject to this tax. Web sales and use tax rates madera county 7.75%. Web sales tax calculator | sales tax table sales tax table this sales tax table. 6.5 / 100 = 0.065 multiply price by decimal tax rate: Transactions between companies are not subject to this tax. Sales tax is one of these. Web divide tax percentage by 100: Web 8.25% tax schedule the contents of this schedule may be reproduced state of california 8.25% sales tax reimbursement — california department of tax and fee administration civil. Sales tax is one of these. Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax schedule) lists the. Most often, this tax is levied on the final buyer. 70 * 0.065 = 4.55 you will pay $4.55 in tax on a $70 item add tax to list price to get total price: 6.5 / 100 = 0.065 multiply price by decimal tax rate: Web 8.25% sales tax calculator online. Town of corte madera 9.00%. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. City of san rafael 9.25%. Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Town of san anselmo 9.25%. Web divide tax percentage by 100: These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. City of. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country flourishes. To use this chart, locate the row that contains the purchase price. Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax. Web divide tax percentage by 100: Sales tax is one of these. Web 8.25% tax schedule the contents of this schedule may be reproduced state of california 8.25% sales tax reimbursement — california department of tax and fee administration civil code section 1656.1 to City of san rafael 9.25%. Web 8.25% sales tax calculator online. Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. To use this chart, locate the row that contains the purchase price. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; City of san rafael 9.25%. 70 * 0.065 = 4.55 you will pay $4.55 in tax on a $70 item add tax to list price to get total price: Web 8.25% sales tax calculator online. 70 + 4.55 = $74.55 sales tax calculation formulas sales tax rate = sales tax percent / 100 sales tax = list price * sales tax rate 6.5 / 100 = 0.065 multiply price by decimal tax rate: Sales tax is one of these. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country flourishes. Town of corte madera 9.00%. Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. Most often, this tax is levied on the final buyer. Transactions between companies are not subject to this tax.Sales Tax Calculator 8.25 printable pdf download

Tax Chart United Faculty of Washington State

Printable Sales Tax Chart Portal Tutorials

Form Boe1808.25 State Of California 8.25 Sales Tax Reimbursement

8.25 Sales Tax Calculator Online. Quickest Way to Calculate it

7.25 Sales Tax Chart Printable Printable Word Searches

Printable Sales Tax Chart Portal Tutorials

Regional sales tax numbers dip slightly, remain strong UCBJ Upper

Printable Sales Tax Chart Portal Tutorials

7.25 Sales Tax Chart Printable Printable Word Searches

Web 8.25% Tax Schedule The Contents Of This Schedule May Be Reproduced State Of California 8.25% Sales Tax Reimbursement — California Department Of Tax And Fee Administration Civil Code Section 1656.1 To

Town Of San Anselmo 9.25%.

Web Divide Tax Percentage By 100:

Web Sales And Use Tax Rates Madera County 7.75%.

Related Post: